- Joined

- 22 Aug 2006

- Messages

- 7,178

- Reaction score

- 1,222

- Country

I heard Paul Lewis on R4 Moneybox complaining that too many people don't know if their pension provider is charging them too much in the annual charge, to hold their pension. I got a little bit cross.

Sure, as he said, if they're charging you 1% where you could get someone else charging you 0.3%, you're wasting £7,000 p.a. (on a £1m pot), and over time that's a lot. He actually said £70,000, but if your pension runs say 35 years - that's a quarter million which would take you maybe a year or ten to earn...

A friend of my wife heard it too, and got worried. Thinking I might know something about pensions because of my stock market dalliances she called me. Sigh. I don't, much. I wanted her to "not take much of my time" , so I asked her how much money she's got, where, and invested in what. Unfortunately she had all the answers. About 400k, through Hargreaves Lansdown, with Prudential, in a fund whose name I've forgotten.. Most of the funds have names like Special SItuations Opportunities Emerging Markets Consolidated Hedged Gofaster Wisdom Advantaged.

Yes she also had the figures for the last 5 years.

Hargreaves L charge 0.45% afaik (because I have a tiny SIPP stuck with them). That's not the lowest by a long way but - pros and cons... So it's costing her £1800 p.a.

Big question, How much has it grown in the last 5 years. Oh, 5.2%, she said. Per year? No, over the 5 years. Bloody hell.

Truth is, a lot of pensions go backwards for short or long periods. Hers is up a tiny bit this year, 1.8% I think. It's disgusting KEEP TRACK OF YOURS.

FInd out what it's called and google it with the words "fund screener". Hopefully you'll get a hit where you can compare it with others.

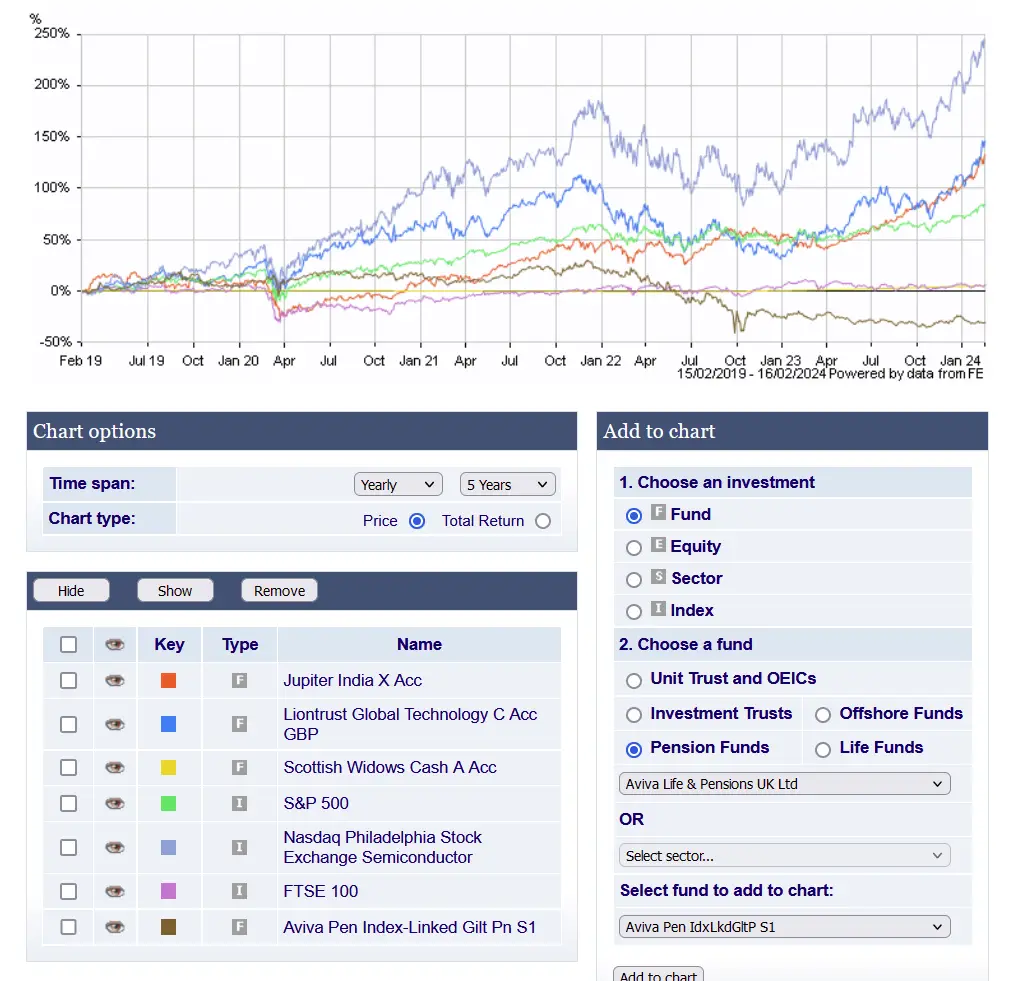

Just as an example, from Hargreaves Lansdown's. HL are just a "holder" - of which there are many. Vanguard , AJBell, etc etc, with different setups. These days the annual fees can be little or nearly zero, so shop around - "consult an IFA". But look at the rates of GROWTH:

(Google ETF SCREENER or FUND SCREENER to give you a wide view).

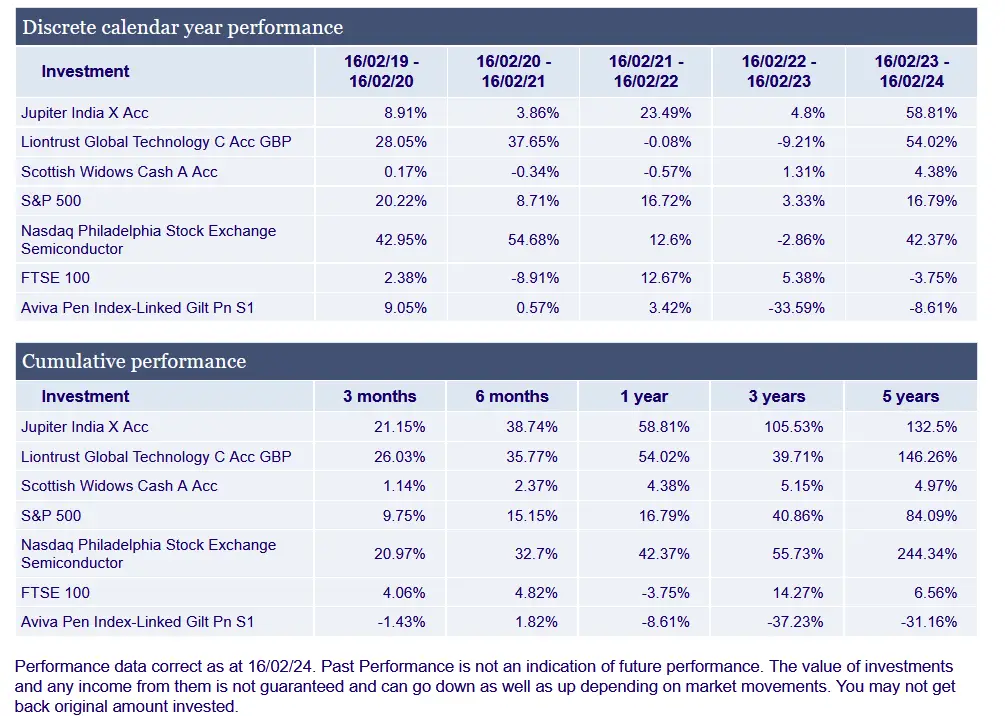

WIth these few, an initial £1000 would have become between £600 and £2500.

For clarirty - The FTSE100 would have been negligible and sometimes negative, the cash account , which is yellow and hard to see, (there are many, money marlet, etc) would have been almost flat, but positive. The Index Linked one is a joke. Like MANY, you'd have less than when you started.

Most have done better at some times than others. Since 1st Jan this year, my H & L SIPP is up something like 15%, in Jupiter India and a Technology fund. (Some was in Japan).

Make sure that if you're in any fund which can go backwards, you can swap it to Money Market, or something FLAT so you don't suffer the loss.

Ideally of course, review it every month or so , so you can change the mix.

A few notes:

Some funds are marked Dist(ribution) which means they pay dividends - which can be very little. Acc(umulation) versions put the divs back into the fund.

YTD means Year to Date, ie since Jan 1st this year.

If you want, you can put some types of pensions into shares, bonds, whatever you like. Not all - you'll have to ask.

It will usually take you a few days to move a pension fund but you shouldn't lose value. Some banks etc will charge a fee say £30 for that, HL for example is free.

You can't invest through a provider directly into an Index as such, but there will be a Fund which mirrors it.

The S & P 500 is a fair choice if you want zero thought, because it's the most successful 500 US companies. Weaker ones drop out and get replaced, over time.

There are funds like S & P x2 or x3, if you're feeling brave.

Dividend-biased funds can give you an income AND grow, but you need to be really on top of those.

Mutual finds - google those.

I day-trade at the moment. It's quick, you can be in and out of a stock, or fund, several times a day. 10% a day is ordinary, depending. Obviously that's impractical for anyone with a life. But if you had a few funds, and you looked at them and drew the charts (plenty of free services do that for you) say every couple of weeks, you could have turned that £1000 into a multiple of that in 5 years , quite reasonaby. EG after COVID (April '20), the Healthcare sector took off for a while - no surprise. Trends last long enough that you can ride a wave. DON'T jump in, take advice, watch and read and learn for a while first.

Sure, as he said, if they're charging you 1% where you could get someone else charging you 0.3%, you're wasting £7,000 p.a. (on a £1m pot), and over time that's a lot. He actually said £70,000, but if your pension runs say 35 years - that's a quarter million which would take you maybe a year or ten to earn...

A friend of my wife heard it too, and got worried. Thinking I might know something about pensions because of my stock market dalliances she called me. Sigh. I don't, much. I wanted her to "not take much of my time" , so I asked her how much money she's got, where, and invested in what. Unfortunately she had all the answers. About 400k, through Hargreaves Lansdown, with Prudential, in a fund whose name I've forgotten.. Most of the funds have names like Special SItuations Opportunities Emerging Markets Consolidated Hedged Gofaster Wisdom Advantaged.

Yes she also had the figures for the last 5 years.

Hargreaves L charge 0.45% afaik (because I have a tiny SIPP stuck with them). That's not the lowest by a long way but - pros and cons... So it's costing her £1800 p.a.

Big question, How much has it grown in the last 5 years. Oh, 5.2%, she said. Per year? No, over the 5 years. Bloody hell.

Truth is, a lot of pensions go backwards for short or long periods. Hers is up a tiny bit this year, 1.8% I think. It's disgusting KEEP TRACK OF YOURS.

FInd out what it's called and google it with the words "fund screener". Hopefully you'll get a hit where you can compare it with others.

Just as an example, from Hargreaves Lansdown's. HL are just a "holder" - of which there are many. Vanguard , AJBell, etc etc, with different setups. These days the annual fees can be little or nearly zero, so shop around - "consult an IFA". But look at the rates of GROWTH:

(Google ETF SCREENER or FUND SCREENER to give you a wide view).

WIth these few, an initial £1000 would have become between £600 and £2500.

For clarirty - The FTSE100 would have been negligible and sometimes negative, the cash account , which is yellow and hard to see, (there are many, money marlet, etc) would have been almost flat, but positive. The Index Linked one is a joke. Like MANY, you'd have less than when you started.

Most have done better at some times than others. Since 1st Jan this year, my H & L SIPP is up something like 15%, in Jupiter India and a Technology fund. (Some was in Japan).

Make sure that if you're in any fund which can go backwards, you can swap it to Money Market, or something FLAT so you don't suffer the loss.

Ideally of course, review it every month or so , so you can change the mix.

A few notes:

Some funds are marked Dist(ribution) which means they pay dividends - which can be very little. Acc(umulation) versions put the divs back into the fund.

YTD means Year to Date, ie since Jan 1st this year.

If you want, you can put some types of pensions into shares, bonds, whatever you like. Not all - you'll have to ask.

It will usually take you a few days to move a pension fund but you shouldn't lose value. Some banks etc will charge a fee say £30 for that, HL for example is free.

You can't invest through a provider directly into an Index as such, but there will be a Fund which mirrors it.

The S & P 500 is a fair choice if you want zero thought, because it's the most successful 500 US companies. Weaker ones drop out and get replaced, over time.

There are funds like S & P x2 or x3, if you're feeling brave.

Dividend-biased funds can give you an income AND grow, but you need to be really on top of those.

Mutual finds - google those.

I day-trade at the moment. It's quick, you can be in and out of a stock, or fund, several times a day. 10% a day is ordinary, depending. Obviously that's impractical for anyone with a life. But if you had a few funds, and you looked at them and drew the charts (plenty of free services do that for you) say every couple of weeks, you could have turned that £1000 into a multiple of that in 5 years , quite reasonaby. EG after COVID (April '20), the Healthcare sector took off for a while - no surprise. Trends last long enough that you can ride a wave. DON'T jump in, take advice, watch and read and learn for a while first.

Last edited: