- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

So for 2026....

I'm looking at which largest sectors have done best in 2025.

Wouldn't it be nice to just use a low cost index fund and forget about it?

No not really!.

You can't even just for "global" to get an equal contribution from everywhere, because so much of the global market comes from the USA, and so much of the USA is about 10 companies, overall leaning on AI quite heavily.

Vanguard is a platform which is good for "low cost Index" hunters, so to look at what's where:

www.justetf.com

www.justetf.com

WHich would you pick as a reasonable punt for a long period, from here, having looked at the performances for the past 12 or 6 months?:

Asia/Pacific is not a homogeneous group. You have Japan, China and smaller ones - Korea, Taiwan, Vietnam, each doing their own unaligned thing

Europe though, tends to more in a more "together" way.

USA is still the centre of world growth, but mostly because of AI.

BUT The dollar weakened by about 7% over the year.

The Euro strengthened by about 4% over the year.

That means if you bought the USA fund, it got reduced in GBP terms, but the European one was aided.

In both cases you can get a hedged fund, which seeks to reduce the effect of currency shifts. . The USA Hedged ones would therefore have been a couple of percent better for you, european hedged, worse

Europe UNhedged, then, did best over the 12 months , at 20% ish.

With the far east, you have e.g JYen or Chinese Juan to USD to GBP rates , all changing, so they can be very significant too. Makes it hard.

TRump wants the dollar to weaken further - look out.

For an AI play, you could use the Dutch company ASML, which makes the 400m Euro machines which make the machines which make the chips.

Use Europe then, or you could use an overall ETF/OEIC Fund, then tweak it by using some of, e.g. Barings 3x Germany , or a Euro defence fund if that's what's cookin. Or Euro Banking, which has been doing very well.

Spain was rising for a useful period. To understand and use something like that, you would have to be constantly watching, and googling for reasons why.

Most of the wunnerful earnings figures, growths and therefore stock gains, HAVE been in the USA though.

The problem can be that some are annoyingly volatile. Solid old Apple did nothing for ages, just getting its Dollar value reduce by 7% - ouch.

There ARE some fund managers who know their onions from their Apples, and MANAGE funds to do better than simple stock picks. Some use US or other global stocks, as they choose. One is Artemis Global Income:

This chart is a bit busy but shows what I've been on about. General USA = S&P 500, not great. Europe (unhedged) quite a lot better(yellow). Those are unmanaged, index funds.

Orange is the Managed US fund - it did well, but see how badlly it was hit when the market objected to Trump's board of tariffs, in April.

European funds were bothered less, and gold barely at all.

Note Europe Unhedged, benefitted as above from the strengthening Euro, (green) so it's higher than the hedged version(blue).

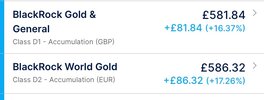

See also how Gold was FAB at times, but pretty choppy, and ultimately not so extra great by year end.

Note how the Europe OEICS are better then the sector curve(yellow based on share prices.

Hope that all makes sense.

RIght, now I'll leave the green one on the next chart, it's Europe unhedged, but add European Banks 3x, and Gold Miners 3x (both 3x leveraged)

plus 3x each of Barclays, Rolls Royce, Lloyds Bank Grp.

NOte the % growths, on the left axis.

European Banks 3x, (3BAL) has crushed it. 3x Gold Miners (3GDX) is higher but so volatile you could have been down 50% on your money at one point.

These all work in ISAs, (or SIPPs) so they're tax free.

Resumé so far:

If you're happy at 12% or so , see previous posts, use a bond thing. Fairly immune from an AI crash.

Better rate, would have been to use Europe. Higher returns this last year, and less damaged by USA stocks drop.

3x European BANks (3BAL) would have seen you very happy.

If you'd used 3x Gold miners (the miners go faster than the metal) then you could have done better again, or got caught quite badly.

Continues...

I'm looking at which largest sectors have done best in 2025.

Wouldn't it be nice to just use a low cost index fund and forget about it?

No not really!.

You can't even just for "global" to get an equal contribution from everywhere, because so much of the global market comes from the USA, and so much of the USA is about 10 companies, overall leaning on AI quite heavily.

Vanguard is a platform which is good for "low cost Index" hunters, so to look at what's where:

The Best Vanguard ETFs 2026

Compare the best Vanguard ETFs 2026 at a glance. Currently, the best performing ETF with 12.48% is the Vanguard FTSE Developed Asia Pacific ex Japan UCITS ETF Distributing.

WHich would you pick as a reasonable punt for a long period, from here, having looked at the performances for the past 12 or 6 months?:

Asia/Pacific is not a homogeneous group. You have Japan, China and smaller ones - Korea, Taiwan, Vietnam, each doing their own unaligned thing

Europe though, tends to more in a more "together" way.

USA is still the centre of world growth, but mostly because of AI.

BUT The dollar weakened by about 7% over the year.

The Euro strengthened by about 4% over the year.

That means if you bought the USA fund, it got reduced in GBP terms, but the European one was aided.

In both cases you can get a hedged fund, which seeks to reduce the effect of currency shifts. . The USA Hedged ones would therefore have been a couple of percent better for you, european hedged, worse

Europe UNhedged, then, did best over the 12 months , at 20% ish.

With the far east, you have e.g JYen or Chinese Juan to USD to GBP rates , all changing, so they can be very significant too. Makes it hard.

TRump wants the dollar to weaken further - look out.

For an AI play, you could use the Dutch company ASML, which makes the 400m Euro machines which make the machines which make the chips.

Use Europe then, or you could use an overall ETF/OEIC Fund, then tweak it by using some of, e.g. Barings 3x Germany , or a Euro defence fund if that's what's cookin. Or Euro Banking, which has been doing very well.

Spain was rising for a useful period. To understand and use something like that, you would have to be constantly watching, and googling for reasons why.

Most of the wunnerful earnings figures, growths and therefore stock gains, HAVE been in the USA though.

The problem can be that some are annoyingly volatile. Solid old Apple did nothing for ages, just getting its Dollar value reduce by 7% - ouch.

There ARE some fund managers who know their onions from their Apples, and MANAGE funds to do better than simple stock picks. Some use US or other global stocks, as they choose. One is Artemis Global Income:

This chart is a bit busy but shows what I've been on about. General USA = S&P 500, not great. Europe (unhedged) quite a lot better(yellow). Those are unmanaged, index funds.

Orange is the Managed US fund - it did well, but see how badlly it was hit when the market objected to Trump's board of tariffs, in April.

European funds were bothered less, and gold barely at all.

Note Europe Unhedged, benefitted as above from the strengthening Euro, (green) so it's higher than the hedged version(blue).

See also how Gold was FAB at times, but pretty choppy, and ultimately not so extra great by year end.

Note how the Europe OEICS are better then the sector curve(yellow based on share prices.

Hope that all makes sense.

RIght, now I'll leave the green one on the next chart, it's Europe unhedged, but add European Banks 3x, and Gold Miners 3x (both 3x leveraged)

plus 3x each of Barclays, Rolls Royce, Lloyds Bank Grp.

NOte the % growths, on the left axis.

European Banks 3x, (3BAL) has crushed it. 3x Gold Miners (3GDX) is higher but so volatile you could have been down 50% on your money at one point.

These all work in ISAs, (or SIPPs) so they're tax free.

Resumé so far:

If you're happy at 12% or so , see previous posts, use a bond thing. Fairly immune from an AI crash.

Better rate, would have been to use Europe. Higher returns this last year, and less damaged by USA stocks drop.

3x European BANks (3BAL) would have seen you very happy.

If you'd used 3x Gold miners (the miners go faster than the metal) then you could have done better again, or got caught quite badly.

Continues...

Last edited: