- Joined

- 7 Jan 2010

- Messages

- 14,185

- Reaction score

- 4,194

- Country

Me £175

SWMBO £125

Son £475

Daughter SFA

SWMBO £125

Son £475

Daughter SFA

6.6% is a decent return for a high rate taxpayer, it's 12% equivalent. ( 6.6/0.55, is that right, I'm tired?)£275. Not a bad start. I'd have to invest it at 6.6% to get that per month. Tax free too.

View attachment 383177

6.6% is a decent return for a high rate taxpayer, it's 12% equivalent.

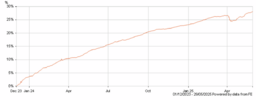

The "base" fund I've been quoting has a flattening curve. This is the past 18 months; the last 12 monbths is about 12%, but you would be taxed on it as CGT. The highest rate for that is 24%, which takes the 12 down to 9.12.

View attachment 383187

What am I missing? - if you earn £12 and your highest marginal rate is 45%, you get 6.60.I make that 9.6% for a top rate tax payer and 9.2% for a high rate tax payer. Were you compounding the winnings/dividends back in to the investment? If you are at the max, you can't do that.