HL is ok. A bit expensive on the holding fee at 0.45% but it's soon reducing to 0.35.

What you did is sensible.

The only variation I would have suggested, but probably not actually bothered to do (!) is to buy half of each to start with, in case one goes ti tsup.

Let me know what you have and I can squeal If I see something.

There will be lots of wrinkles to learn.

One is that you have to order by 8 a.m if you want to buy or sell something that day. Sometimes they "submit" before thea 8am, sometimes a bit later. After that time you can't cancel.

One thing you may not have found yet is the Portfolio analysis tool. It's very good and my other platforms don't have it.

You can easily add another fund tp the graph to see what would have happened, etc.

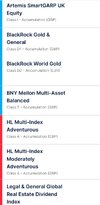

Two you might want to compare with, if you don't have them in your 5, are

Artemis Global Income

Barings South Korea

For the tech sector the one I found best is Polar Capital Glocal Tech Hedged. It's an "offshore" fund, Ireland. Lots are.

HL's screener is pretty useless, because it only goes down to 3 months. Yry the one at AJ Bell. The main funds are at HL as well.

Silver and Gold took a hit today when Scott Bessant said something minor - their prices are fragile, so I got out of most of them. Everyone's waiting for a sizeable pullback, though they may well go back up after. Kept some gold.

Silver IS in short supply, but AI thought 20% of the price was speculator's effect, so it's fickle.