I follow almost nothing of what you're saying about vwap. Surely the period of it is the same as that of the chart you are viewing? I don't know what the pointer with info is - if I put the cursor over it I can see the level off the chart axis at the side. If I try to add the avwap indicator on tradingview I get a list of about thirty indicators, the first of which is locked, and the others of which require me to sign up for a free trial, so will only be temporary in any case.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock market dealing

- Thread starter Justin Passing

- Start date

- 21/02/2024 20:57

NVIDIA Corp (All Sessions)

+0.20

67394

67380

-£2.80 - 21/02/2024 20:33

Teladoc Health Inc

-1

1551.7

1537.3

£14.40 - 21/02/2024 20:09

NVIDIA Corp (All Sessions)

-0.10

67058

66354

£70.40 - 21/02/2024 19:11

NVIDIA Corp (All Sessions)

-0.10

67222

67494

-£27.20 - 21/02/2024 17:28

NVIDIA Corp (All Sessions)

-0.10

67953

67133

£82.00 - 21/02/2024 17:20

ARM Holdings PLC - ADR

+0.50

12107

11998.5

-£54.25 - 21/02/2024 17:04

Alibaba Group Holding Ltd (All Sessions)

-1

7543

7601

-£58.00 - 21/02/2024 16:27

ARM Holdings PLC - ADR

-0.50

12381

12334

£23.50 - 21/02/2024 15:46

ARM Holdings PLC - ADR

+0.50

12213

12177

-£18.00 - 21/02/2024 15:21

Amazon.com Inc (All Sessions)

+0.25

16929

16801

-£32.00 - 21/02/2024 15:13

Amazon.com Inc (All Sessions)

+0.25

16930

16859

-£17.75 - 21/02/2024 15:00

NVIDIA Corp (All Sessions)

-0.10

68145

68324

-£17.90 - Total

-£37.60

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

Anchored Volume Weighted Average Price is the one which starts doing the averaging wherever you set the anchor. On a good platform you can set it where you like.

If at 9 am UK you're using an unanchored VWAP, say set to 100 period on a 5 minute chart, then you're looking at an average over the last 500 minutes, which would be previous day plus. If it's anchored at start of day, you would be looking at an average since 8am, ie over the last 60 minutes. So for instance in T212 CFD's unanchored VWAP you could set 60.

TradingView isn't great, it only anchors at eg start of day, though that's the most useful. With eg TC2000 platform, you can anchor the thing to a point during the day, or start of year, or last night when the results came out.

The champion of AVWAP is Brian Shannon who runs Alphatrades. He's a bright cookie. Of course he has a book to sell, but he's worth looking up . Regularly posts on X, TTV have him on to boost their show profile and plug his book...

We're told that, like the 200 and 50 period SMAs on the daily, bots and trading systems use it to influence their trades. It becomes self-fulfilling. Prices DO bounce off them.

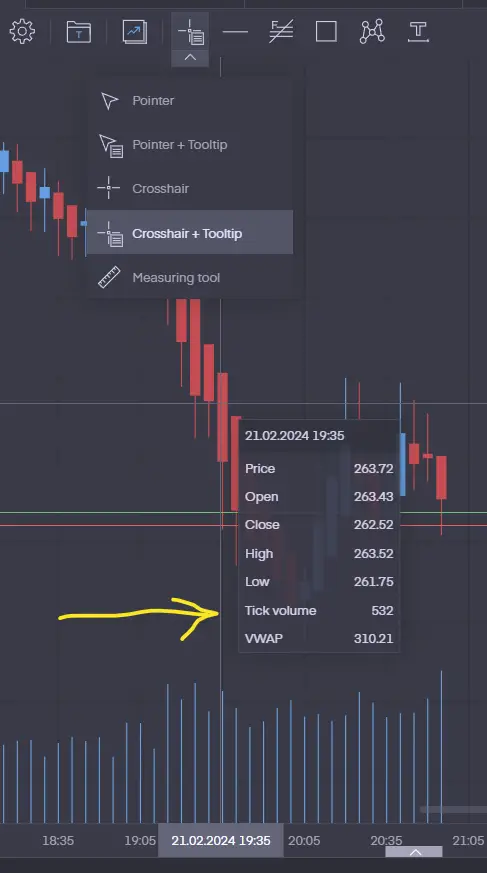

T212 volume

You need the pointer/crosshair with the extra info, called Tooltip. Then you get a number which presumably is something to do with what it says. DOn't bother asking T212 people, thay won't even know it exists, There's a chance the BOT might say something. It's a clever bot though it's not always right. (If it gives you a wrong answer, you can teach it, and it remembers. AI for you.)

Ignorance is widespread. I asked what a trading volume of "50" meant on TradingView, and I was told it was the number of shares (Like everywhere, the bloke said). I told him he didn't know what he was talking about. I'd bought 100 shares..... !

I still don't know for sure what it means. 50 lots of 100,000? I assume it's proportional , so good enough, but it annoys me.

Trading212 are ****. They won't admit if they don't know. They ask for screenshots, then movies, then say they'll get back to you, but they never do.

Those TP and SL tabs I told you about, I was told were just screen artefacts which didn't do anything. Right..... wrong.

Their stoplosses often trigger when the price is nowhere near.

First they said no they do not, then it was "Gapping", and other BS. It was my fault, they were only "indicative". Utter bucking follox.

They'll tell you anything to get rid of you.

"Nobody else has ever said it has done that". So I posted a number of posts from their heavily censored forum which had vanished, but I'd taken screenshots for my own trials.

I reposted them with a short video of it happening. They said they'd look in to it. Then deleted the posts.

I ought to move platform, but I'm a bit lazy and haven't found a cheap one which does what I want.

It does allow infinite alerts, and a load of charts at once, so I'll keep it whatever I do.

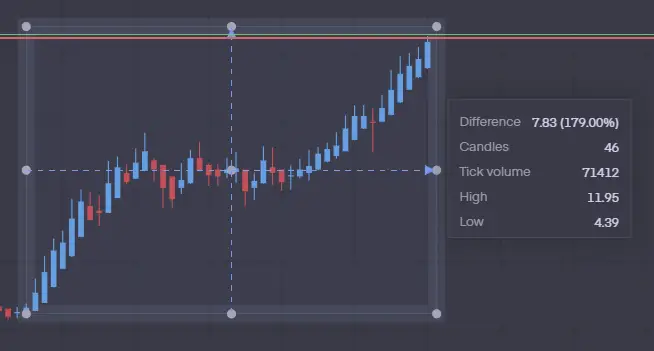

ANother T212 tip - if you use the crosshair to measure percentages (ie by just dragging the mounse) it'll often pick up whatever id on the screen, which you don't want. If you tap SHIFT first, it uses the Ruler/box tool, which is much better. Then it forgets it, which is usually what you want.

You can get 16 charts at once with the auto icon in the selector for 2/4/6/ etc.

You can duplicate tabs and then use a separate set of 16.

Chrome is better than Firefox.

If you want to pre-set a share size, you must put the share in a Watchlist first, where you can use a padlock thing to lock the number. Trouble is, it can forget at some random time. So you just hit "buy" to get another 20 shares like you just did, and it has reset to 250, or 1250 or whatever you can just about use all your pot for. DIsgusting, they do it on purpose because it 99% of the time makes you quit and lose.

Also the muse-click is unpredictable. Sometimes you have to hold the button down to get one click, then it doubles up. It's not the mouse, I tried 3. If you slightly miss the undefined Close button, it goes off to do something else because it thinks you clicked on that. Awful. You lose again.

I'm sure they've done it on purpose. When you lose, they win, simple.

They're taking the other side of the trade - it only goes to market sometime, via a bot, if you win.

---

Not a great day but Nat Gas was moving for a few % so I used that.

I see you're down again. Hope it's not hurting too much. Are you retired?

NVIDIA is up again I see after earnngs, but not much. So the bubble inflates further. Longer term I'm long in India and Asia/Japan. Probably something like Tesla would be good to buy now as it's low.

For a while there's an ETF called 3SMH which should be doing well. (3x long semiconductors) Deffo add a stop loss!

If at 9 am UK you're using an unanchored VWAP, say set to 100 period on a 5 minute chart, then you're looking at an average over the last 500 minutes, which would be previous day plus. If it's anchored at start of day, you would be looking at an average since 8am, ie over the last 60 minutes. So for instance in T212 CFD's unanchored VWAP you could set 60.

TradingView isn't great, it only anchors at eg start of day, though that's the most useful. With eg TC2000 platform, you can anchor the thing to a point during the day, or start of year, or last night when the results came out.

The champion of AVWAP is Brian Shannon who runs Alphatrades. He's a bright cookie. Of course he has a book to sell, but he's worth looking up . Regularly posts on X, TTV have him on to boost their show profile and plug his book...

We're told that, like the 200 and 50 period SMAs on the daily, bots and trading systems use it to influence their trades. It becomes self-fulfilling. Prices DO bounce off them.

T212 volume

You need the pointer/crosshair with the extra info, called Tooltip. Then you get a number which presumably is something to do with what it says. DOn't bother asking T212 people, thay won't even know it exists, There's a chance the BOT might say something. It's a clever bot though it's not always right. (If it gives you a wrong answer, you can teach it, and it remembers. AI for you.)

Ignorance is widespread. I asked what a trading volume of "50" meant on TradingView, and I was told it was the number of shares (Like everywhere, the bloke said). I told him he didn't know what he was talking about. I'd bought 100 shares..... !

I still don't know for sure what it means. 50 lots of 100,000? I assume it's proportional , so good enough, but it annoys me.

Trading212 are ****. They won't admit if they don't know. They ask for screenshots, then movies, then say they'll get back to you, but they never do.

Those TP and SL tabs I told you about, I was told were just screen artefacts which didn't do anything. Right..... wrong.

Their stoplosses often trigger when the price is nowhere near.

First they said no they do not, then it was "Gapping", and other BS. It was my fault, they were only "indicative". Utter bucking follox.

They'll tell you anything to get rid of you.

"Nobody else has ever said it has done that". So I posted a number of posts from their heavily censored forum which had vanished, but I'd taken screenshots for my own trials.

I reposted them with a short video of it happening. They said they'd look in to it. Then deleted the posts.

I ought to move platform, but I'm a bit lazy and haven't found a cheap one which does what I want.

It does allow infinite alerts, and a load of charts at once, so I'll keep it whatever I do.

ANother T212 tip - if you use the crosshair to measure percentages (ie by just dragging the mounse) it'll often pick up whatever id on the screen, which you don't want. If you tap SHIFT first, it uses the Ruler/box tool, which is much better. Then it forgets it, which is usually what you want.

You can get 16 charts at once with the auto icon in the selector for 2/4/6/ etc.

You can duplicate tabs and then use a separate set of 16.

Chrome is better than Firefox.

If you want to pre-set a share size, you must put the share in a Watchlist first, where you can use a padlock thing to lock the number. Trouble is, it can forget at some random time. So you just hit "buy" to get another 20 shares like you just did, and it has reset to 250, or 1250 or whatever you can just about use all your pot for. DIsgusting, they do it on purpose because it 99% of the time makes you quit and lose.

Also the muse-click is unpredictable. Sometimes you have to hold the button down to get one click, then it doubles up. It's not the mouse, I tried 3. If you slightly miss the undefined Close button, it goes off to do something else because it thinks you clicked on that. Awful. You lose again.

I'm sure they've done it on purpose. When you lose, they win, simple.

They're taking the other side of the trade - it only goes to market sometime, via a bot, if you win.

---

Not a great day but Nat Gas was moving for a few % so I used that.

I see you're down again. Hope it's not hurting too much. Are you retired?

NVIDIA is up again I see after earnngs, but not much. So the bubble inflates further. Longer term I'm long in India and Asia/Japan. Probably something like Tesla would be good to buy now as it's low.

For a while there's an ETF called 3SMH which should be doing well. (3x long semiconductors) Deffo add a stop loss!

Last edited:

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

Remember I mentioned Mongolian Mining, in HK? (It's coal!!)

Daily candles:

Not bad.

Daily candles:

Not bad.

I don't intend to trade on 212, given the difficulties you describe. I have just been using it to find vwap, since they talk about it so much on tradertv, and on IG it's often not available. Who knows if it's right though? At the moment 212's vwap on BP 1 minute is 471.49, while IG's is 471.02, so it seems strange to trade based on it. When tradertv talks about vwap it's often way out of line with either.

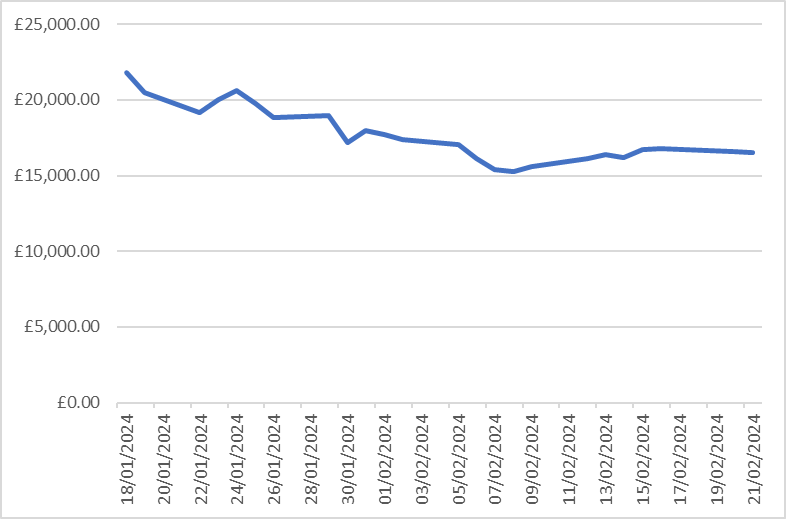

I'm essentially retired, although I'm still in my 50s. People tend to say that I'm too young to be retired when I tell them this. But (a) I applied for quite a lot of jobs last year, and didn't get anywhere (ageism is still very real I think), and (b) I've paid my mortgage off and my savings can probably see me through until I start drawing my pensions. So I might as well just be retired. This stock market trading would be nice if it could make me some extra income, but so far, I'm succeeding in showing that, as I predicted at the outset, it doesn't work. Here's my progress for the last month. I suppose it has at least been improving in the second half. But it's a lot of time to spend in order to lose money.

I'm essentially retired, although I'm still in my 50s. People tend to say that I'm too young to be retired when I tell them this. But (a) I applied for quite a lot of jobs last year, and didn't get anywhere (ageism is still very real I think), and (b) I've paid my mortgage off and my savings can probably see me through until I start drawing my pensions. So I might as well just be retired. This stock market trading would be nice if it could make me some extra income, but so far, I'm succeeding in showing that, as I predicted at the outset, it doesn't work. Here's my progress for the last month. I suppose it has at least been improving in the second half. But it's a lot of time to spend in order to lose money.

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

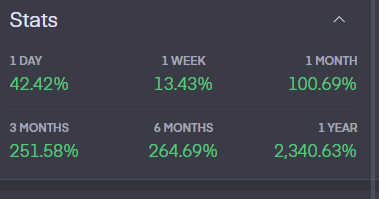

But all you had to do was buy the right stock

3nvd

That 3xSMH I mentioned only did 22%. Today.

and SMCI 33%

I started with NVDA but it slowed down at about 4% so I switched to SMC which carried on up 13%

(gaps excluded).

SO you know where this is going -

About 80 k x 17% x 5.

Three trades. One NVDA, 2 on SMC because I stopped in the middle when it dropped. Didn't short it though, it's a beeest.

I have to say I think you're overcomplicating it with all the trades you normally do.

Today we knew there would be a monster reaction to the NVDA results, and we knew the direction.

Did you do well?.

SMC went up 100$ plus, after the gap. SO at $5 a point... that's 50k, right??

MAny days I call myself stupid, but the way I do it seems to work. You know the Einstein thing about expecting different results if you do things the same way.

Sometimes I miss a stock completely, but it's usually one of half a dozen or so I should have used.

The "low cap gappers" are tooooo risky, they flip on a tanner...

You could do what I keep telling myself to do - swing trade. Somewwhere I have a graph of 5qqq for last year, It's about 300% up if you take out just some of the red stretches. It may be here, not sure.

Tomorrow it will be somewhat similar- same names going nuts, plus CVNA, SQ maybe

Check Mongolian again tonight

3nvd

That 3xSMH I mentioned only did 22%. Today.

and SMCI 33%

I started with NVDA but it slowed down at about 4% so I switched to SMC which carried on up 13%

(gaps excluded).

SO you know where this is going -

About 80 k x 17% x 5.

Three trades. One NVDA, 2 on SMC because I stopped in the middle when it dropped. Didn't short it though, it's a beeest.

I have to say I think you're overcomplicating it with all the trades you normally do.

Today we knew there would be a monster reaction to the NVDA results, and we knew the direction.

Did you do well?.

SMC went up 100$ plus, after the gap. SO at $5 a point... that's 50k, right??

MAny days I call myself stupid, but the way I do it seems to work. You know the Einstein thing about expecting different results if you do things the same way.

Sometimes I miss a stock completely, but it's usually one of half a dozen or so I should have used.

The "low cap gappers" are tooooo risky, they flip on a tanner...

You could do what I keep telling myself to do - swing trade. Somewwhere I have a graph of 5qqq for last year, It's about 300% up if you take out just some of the red stretches. It may be here, not sure.

Tomorrow it will be somewhat similar- same names going nuts, plus CVNA, SQ maybe

Check Mongolian again tonight

OK, so the moves are big. But how do you choose the right stock? Why didn't you choose Intel today (one of the stocks on your list in the other thread)? £80K * 5*-3% = -£12K.

I didn't trade NVDA because there wasn't much pullback. I did better, but got out of Moderna far too soon. You did say once to get out of a trade quickly if it's going against you, so that's what I did.

Maybe I'll look at Mongolian, but it's not on ig, only 212.

I didn't trade NVDA because there wasn't much pullback. I did better, but got out of Moderna far too soon. You did say once to get out of a trade quickly if it's going against you, so that's what I did.

Maybe I'll look at Mongolian, but it's not on ig, only 212.

- 22/02/2024 16:47

Nano-X Imaging Limited

+4

907.4

889.1

-£73.20 - 22/02/2024 16:46

Nano-X Imaging Limited

+2

907.4

888.7

-£37.40 - 22/02/2024 16:21

Wayfair Inc

+0.35

5054

5083

£10.15 - 22/02/2024 16:00

Wayfair Inc

+0.15

5054

5012

-£6.30 - 22/02/2024 15:52

Alphabet Inc - A (All Sessions)

+0.30

14434

14361

-£21.90 - 22/02/2024 15:50

Moderna Inc (All Sessions)

+0.40

9482

9493

£4.40 - 22/02/2024 15:47

Moderna Inc (All Sessions)

+0.20

9482

9492

£2.00 - 22/02/2024 15:40

Alphabet Inc - A (All Sessions)

+0.20

14434

14398

-£7.20 - 22/02/2024 15:12

Moderna Inc (All Sessions)

+0.40

9329

9449

£48.00 - 22/02/2024 15:10

Moderna Inc (All Sessions)

+0.20

9329

9497

£33.60 - 22/02/2024 15:10

Moderna Inc (All Sessions)

+0.20

9329

9516

£37.40 - 22/02/2024 15:00

Nano-X Imaging Limited

+2

939.4

928.6

-£21.60 - 22/02/2024 15:00

Nano-X Imaging Limited

+2

939.4

928.6

-£21.60 - 22/02/2024 14:49

Nano-X Imaging Limited

+2

914.4

951.6

£74.40 - 22/02/2024 14:48

Nano-X Imaging Limited

+2

914.4

948.6

£68.40 - 22/02/2024 14:40

Nano-X Imaging Limited

+1

914.4

916.6

£2.20 - Total

£91.35

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

Occasionally I can open in the pre-market, esp a commodity or something with a lot of attention - then the spreads are better. Not at all common though, T212 doesn't give much access.

Intel - with hindsight it would have been good for 20 minutes but I didn't look at it. Mistake, though it didn't continue. It usually doesn't do very much, if you look back, but surely someday they'll bring something out to rattle the market? Often good for a short because its levels are quite firm. TTV didn't look at it....

Only need one/two stocks. I'm not good enough to deal with as many as you do.

Nano-X must have been attention-sapping with all that chopping about.

At the end of the day, when SMC had hit my stop at $999 (a fortunate guess) I was watching the almighty SC, as he shorted something at (say) 100, so did I., for a smallish amount. It dropped to 95 and paused, so I closed. Then it went back to 99 and I was thinking how clever I was. He'd held it all the way back and I'd made a profit. Yay. But then it dropped like a rock and I missed the entry by a little. The spread widened a lot, so by the time it was down at 85, he'd won more $ range than I had. He HAS been doing it 22 years.

It's conflicting - get out very fast or hold right through, are probably both better than fudging it..

If you get it right then yes you're better off.

Adara is poor, she holds everything, including the obviously bad, and Cherif tends to hold a lot. The one I like to watch most is Jannik. He sits, waiting, waiting. He tells you when the setup is approaching and piles in heavily. Then he's out, and waiting again. You don't see him much. There'a new guy Patrick, who passed their tests easily, who ONLY trades Mara. Sometimes he'll use his specialist knowledge to great effect.

I've been inquiring about how to get more screens. Mostly I'd cover them in potential stocks for easy scanning, rather than loads of technical info.

- The Mongolians didn't come out to play. I chased the HK50 around but it wasn't worth it. Japan was shut, too..

I was thinking - Neal always says if your P & L iis suffering, work out what you do most reliably. Wait and do nothing, until the setup is right. Makes sense. I think the safest is going between levels towards the later part of the day. If you don't try to getthe extremes of the zig and zag, you're pretty safe, and you can if necessary hold while it goes on to the next tooth if you cock it up. MSFT and Apple are good for that. Meta's spread is a bit wide. FOr most things the range isn't enough compared with the spread.

Intel - with hindsight it would have been good for 20 minutes but I didn't look at it. Mistake, though it didn't continue. It usually doesn't do very much, if you look back, but surely someday they'll bring something out to rattle the market? Often good for a short because its levels are quite firm. TTV didn't look at it....

Only need one/two stocks. I'm not good enough to deal with as many as you do.

Nano-X must have been attention-sapping with all that chopping about.

At the end of the day, when SMC had hit my stop at $999 (a fortunate guess) I was watching the almighty SC, as he shorted something at (say) 100, so did I., for a smallish amount. It dropped to 95 and paused, so I closed. Then it went back to 99 and I was thinking how clever I was. He'd held it all the way back and I'd made a profit. Yay. But then it dropped like a rock and I missed the entry by a little. The spread widened a lot, so by the time it was down at 85, he'd won more $ range than I had. He HAS been doing it 22 years.

It's conflicting - get out very fast or hold right through, are probably both better than fudging it..

If you get it right then yes you're better off.

Adara is poor, she holds everything, including the obviously bad, and Cherif tends to hold a lot. The one I like to watch most is Jannik. He sits, waiting, waiting. He tells you when the setup is approaching and piles in heavily. Then he's out, and waiting again. You don't see him much. There'a new guy Patrick, who passed their tests easily, who ONLY trades Mara. Sometimes he'll use his specialist knowledge to great effect.

I've been inquiring about how to get more screens. Mostly I'd cover them in potential stocks for easy scanning, rather than loads of technical info.

- The Mongolians didn't come out to play. I chased the HK50 around but it wasn't worth it. Japan was shut, too..

I was thinking - Neal always says if your P & L iis suffering, work out what you do most reliably. Wait and do nothing, until the setup is right. Makes sense. I think the safest is going between levels towards the later part of the day. If you don't try to getthe extremes of the zig and zag, you're pretty safe, and you can if necessary hold while it goes on to the next tooth if you cock it up. MSFT and Apple are good for that. Meta's spread is a bit wide. FOr most things the range isn't enough compared with the spread.

Last edited:

Decided my approach today would be more to look for the right stocks to position myself in over the whole day. I decided Long nvidia, short Rivian, long Carvana, Block and DraftKings. I closed out Rivian earlier than originally intended because it hit a double bottom, and changed my mind on nvidia as it seemed to struggle, and I felt that profit-taking might come into play. My Rivian trade was entered just before the market opened at 212.

- 23/02/2024 20:55

NVIDIA Corp (All Sessions)

-0.05

79405

79071

£16.70 - 23/02/2024 20:52

NVIDIA Corp (All Sessions)

-0.05

79399

79242

£7.85 - 23/02/2024 20:29

Block Inc (All Sessions)

+0.14

8138

7936

-£28.28 - 23/02/2024 20:26

Carvana Company

+0.30

7418

7000

-£125.40 - 23/02/2024 19:06

DraftKings Inc

+0.50

4206

4136

-£35.00 - 23/02/2024 15:30

Rivian Automotive Inc

-2

1017.5

1030.5

-£26.00 - 23/02/2024 15:14

NVIDIA Corp (All Sessions)

-0.05

80796

80691

£5.25 - 23/02/2024 15:07

Carvana Company

+0.20

7418

7122

-£59.20 - 23/02/2024 15:03

Rivian Automotive Inc

-2

1017.5

1018.5

-£2.00 - 23/02/2024 15:02

Block Inc (All Sessions)

+0.14

8014

7903

-£15.54 - 23/02/2024 14:41

NVIDIA Corp (All Sessions)

+0.05

80243

81406

£58.15 - Rivian at 212 £166.2

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

Oh blimmin Heck.

I looked /listeded to the TTV people . Didn't go in from the off, though, as usual, while I looked around. They were mosty wrong, but quite soon it became apparent The chips were going down, so I went short Nvidia. Tried AMD but nvda looked easier so I stuck with it. Gave a few percent.

I found myself at one point on something l;ater where the question of whether to close and lose, or hold, came up:

SOrry I've lost usual apps temporarily;

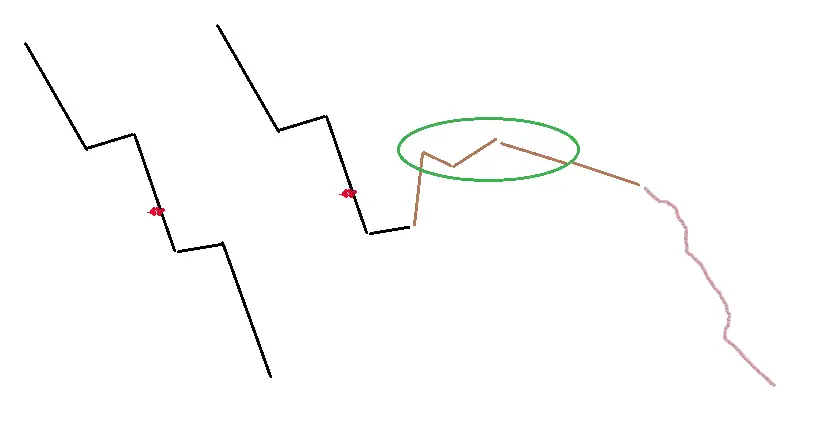

Expecting the left version to happen, I joined Short at the red dot

Then it did the brown line thing so I thought about closing in the green oval. I thought it would carry on down sometime but the problem with closing is the re-entry, you'll always get it a bit wrong. Closing would have lost 4 figures. At that point, you've already lost it, it's gone,, so It's like you're starting afresh. The question becomes where do I go from HERE?

I set a stop loss close, above the line.

I thought it WOULD carry on down at some point.

CLosing gives you the problem of finding a new entry too. I set the SL to allow a bit of fumbling space I would have needed for an entry, and held on. In due course (15 mins I think) it did carry on down the brownish lines, leaving me feeling smug.

So the question is, is this retracement going to go so far it'll be more than I'd lose with a hamfisted re-entry? You can often sort-of tell by the speed of things.

That's what I've been doing, without actually thinking it through. It's like teachers say, you only realise how things work when you try to explain to someone else.

I'll have a look at what you did, later.

I think you made the same mistake, of over-anticipating. That's what they mean by "participate, don't anticipate".

Someone has to maybe get it wrong and lose in order to learn what the trend is. Let it be someone else!

I looked /listeded to the TTV people . Didn't go in from the off, though, as usual, while I looked around. They were mosty wrong, but quite soon it became apparent The chips were going down, so I went short Nvidia. Tried AMD but nvda looked easier so I stuck with it. Gave a few percent.

I found myself at one point on something l;ater where the question of whether to close and lose, or hold, came up:

SOrry I've lost usual apps temporarily;

Expecting the left version to happen, I joined Short at the red dot

Then it did the brown line thing so I thought about closing in the green oval. I thought it would carry on down sometime but the problem with closing is the re-entry, you'll always get it a bit wrong. Closing would have lost 4 figures. At that point, you've already lost it, it's gone,, so It's like you're starting afresh. The question becomes where do I go from HERE?

I set a stop loss close, above the line.

I thought it WOULD carry on down at some point.

CLosing gives you the problem of finding a new entry too. I set the SL to allow a bit of fumbling space I would have needed for an entry, and held on. In due course (15 mins I think) it did carry on down the brownish lines, leaving me feeling smug.

So the question is, is this retracement going to go so far it'll be more than I'd lose with a hamfisted re-entry? You can often sort-of tell by the speed of things.

That's what I've been doing, without actually thinking it through. It's like teachers say, you only realise how things work when you try to explain to someone else.

I'll have a look at what you did, later.

I think you made the same mistake, of over-anticipating. That's what they mean by "participate, don't anticipate".

Someone has to maybe get it wrong and lose in order to learn what the trend is. Let it be someone else!

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

@nwgs asked about Swing Trading. I'll add any stuff I come across that's specific to swing trading in this thread - search on #SwingTrading including the #.

Do google Investopedia etc, but the idea is that you use a stock - or a dozen of them, which are basically sound. You wouldnt use something too volatile like Tesla.

Stocks all go up and down over time even without any inputs .

Some obviously DO have inputs to affect the price.

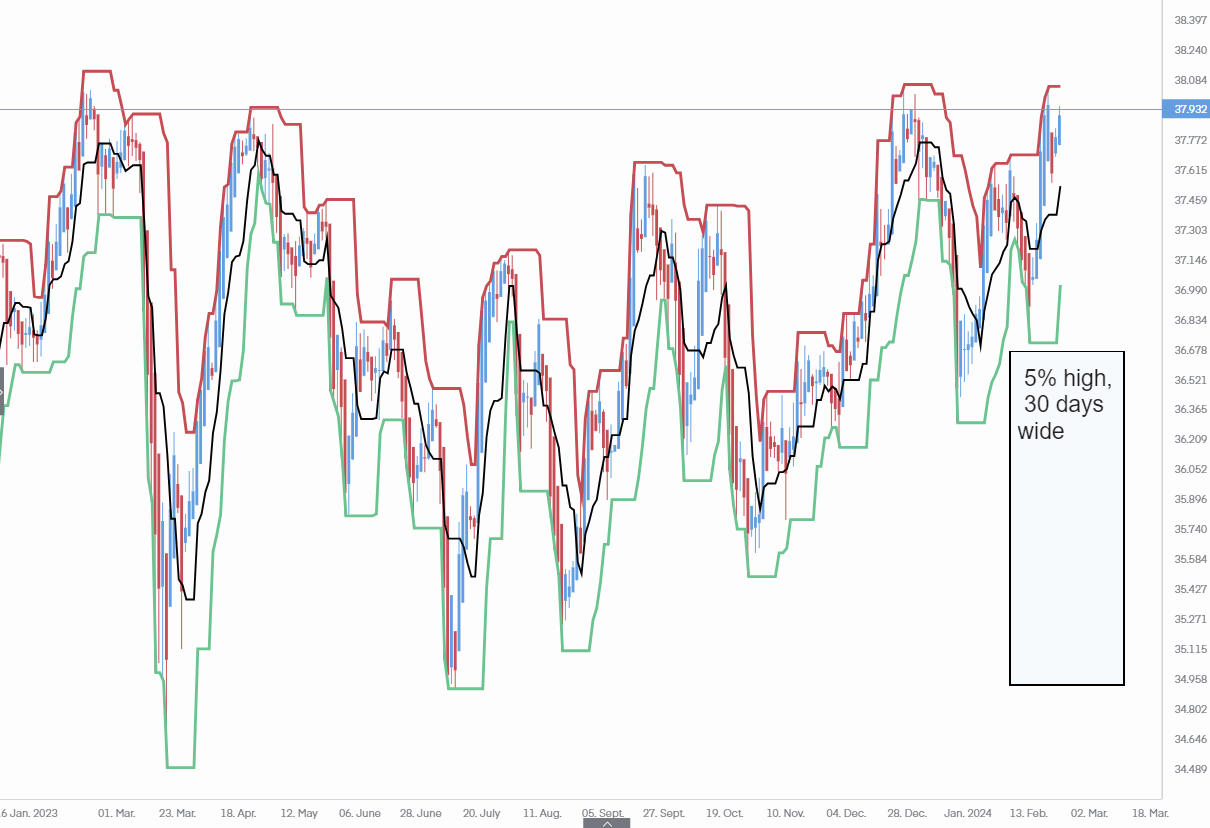

This is the FTSE 100 over the last year and a bit. The price is shown by the candles, which are red and blue.

I added one of the plethora of "indicators" which can be a guide. This one's called the Donchian Channel indicator.. You can adjust its width.

The candles are one day wide , and the DC indicator is set to 8.

You can alter it to suit. Or use something else, like Bollinger Bands.

The idea is that it shows a channel the stock is moving in, so buy when the rice is towards the low (green) and sell when it's near the top (red) like it is now.

There's lots of advice online about how to pick stocks, and wrinkles like when a stock goes "Ex dividend". You can look in to that or use ones which don't give a dividend.

This would be a rather different candidate. Over the whole period this has risen 132%. So if you forgot to sell, you'd be doing jolly well anyway.

In all cases you put a manual, or automatic alarm or "SELL" instruction in , in case it tanks while you aren't watching. ANET:

Here's General Electric for a spell last year. It rose 35% or so but, using manually drawn lines as guides, if you'd been active you could have won a lot more, and done someting else with the dosh in between:

Do google Investopedia etc, but the idea is that you use a stock - or a dozen of them, which are basically sound. You wouldnt use something too volatile like Tesla.

Stocks all go up and down over time even without any inputs .

Some obviously DO have inputs to affect the price.

This is the FTSE 100 over the last year and a bit. The price is shown by the candles, which are red and blue.

I added one of the plethora of "indicators" which can be a guide. This one's called the Donchian Channel indicator.. You can adjust its width.

The candles are one day wide , and the DC indicator is set to 8.

You can alter it to suit. Or use something else, like Bollinger Bands.

The idea is that it shows a channel the stock is moving in, so buy when the rice is towards the low (green) and sell when it's near the top (red) like it is now.

There's lots of advice online about how to pick stocks, and wrinkles like when a stock goes "Ex dividend". You can look in to that or use ones which don't give a dividend.

This would be a rather different candidate. Over the whole period this has risen 132%. So if you forgot to sell, you'd be doing jolly well anyway.

In all cases you put a manual, or automatic alarm or "SELL" instruction in , in case it tanks while you aren't watching. ANET:

Here's General Electric for a spell last year. It rose 35% or so but, using manually drawn lines as guides, if you'd been active you could have won a lot more, and done someting else with the dosh in between:

Last edited:

- Joined

- 22 Aug 2006

- Messages

- 7,160

- Reaction score

- 1,219

- Country

There should have been a new paragraph in my sentence after the closing bracket.I can't see the movements you describe on SMC after it hit 99. Were you trading after the close?

View attachment 334082

I had been holding some SMC, but put my sell stop a tad short of 1000, because round numbers are often resistance where there's no other established leve. Last Friday it crawled up to 1060 but this time it didn't appear to have the same momentum.

I meant "SMC having hit the stop... " Soz.

I didn't re-enter SMC.

SMC can really lurch about on a wide spread, so I don't like it much.

T212 has after-market trading in very few stocks, and Blind a-m-t in others, where you see numbers but no chart.

Cant't remember exactly - it was someone else's method. TradingView has loads of indicators with names not always what you'd think. They have several for levels.Still can't figure out how you get this up:

Try "Volume Profiles" Luxalgo seems to be popular

I have a paid version so may get different ones.

The whole point of the thing is to have loads of charts set up - which I haven't done.

I don't like TradingView much. If you can get it working ut's OK but they don't have proper instructions or a normal help facility, their slow replies show they aren't trained helpers - they can be pretty rude, which is a no-no. Nothing seems obvious. I got screens stuck in a mode I couldn't get out of by resetting whatever I'd just changed. Their reply was "Well did you try the escape key?". No Sherlock, I didn't, - rather obviously.

It hangs the browser too, so use the downloaded version and/or run it in a separate browser.

Last edited: