You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock market dealing

- Thread starter Justin Passing

- Start date

Wow, I think I need to pass on all this and just be happy that I have a company and state pension that fulfil my basic needs of a few beers and holidays and that I can leave the kids a nice inheritance of the house (assuming me and the missis don't end up in care) but good luck with your investmentsNot actually relevant, then!

Sorry, there are so many people raising incorrect and irrelevant tidbits, I try to put them incontext.

Fair enough, some background/précis you'd find lacing through the thread, repeated here to save you wading.

Way back near the start of this thread, I showed the result of putting lumps of money into separate bank accounts - they were fixed interest things you couldn't add to, so the numbers were clearer inseparate accounts.

Startng at 20k, I got to 300k then 500k or so within - I can't remember, a small number of months. I showed the bank accounts on the phone screen. That trajectory continued. When the trading account gets to a something over about 80k I take the excess off and stick it somewhere else - like one of those fixed term accounts. I often wonder what would have happened if I'd used more, but there are limits and things get complicated. I'm pretty lazy...

My trading llimit was based on the 85k secured limit, but that's not particulary logical. Now I use a variety of platforms,

I use ISAs obviously. They're clunkier. You can't "short" as such but can use negative or positive 3x or 5x etfs.

The whole project was to make enough to cover potential old-age costs for both of us. "Homes" cost a lot. eg 1500 up for a week, so the aim is 2 x 1500 x 52 x some number of years - like 10 or 20 is/was a general target.

The other prompt came from when I saw the "growth" of our various pension funds. They seem to think that a couple of percent, after their greedy fees, is good for you. Bucking fowler hat brigade. The Scene is still inhibited by them.

A gentler approach is what's called "swing" trading where you buy near the low side of an ongoing range and sell at the upper edge. Case in pont is the FTSE a couple of years back. A tracker fund would have gone up about 2%, but the index had risen and fallen several times, several percent each time. The total moves added up to 25% iirc, but even with a sloppy approach, selling when it started dropping away from the upper edge, and buying after 3 weeks of rises, would have returned say 10% on the year. I have one isa where that's all I'm doing. If you sell, you're still getting 4+% from the uninvested cash. I have too many accounts so tht happens, but at the moment Barings German Growth and a European one Artemis Smart GARP , are doing well enough. The daily return is around 0.5%, (360%pa) so not sustainable, hence the need for stop-losses. Another one has defense stocks in ETFs, because of the news. Large overlap obviously.

To repeat from way back, the starting method was to look at BItcoin. MARA is a platform for bitcoin trading, and they're a miner. When bitcoin goes up, MARA goes up several times more.

Then you can leverage MARA , times 5.

So BTC woud move maybe 1-2$ in aday, Mara would move 6-12% and leverage then x5 gives you 30-60%, in a day. Quite often it then goes back down again, so once you've gone short you can get the same again. So yes, a few days come out over 100% up. Some of the energy commodities were helping because ther leverage is 20x .

I found the gains pretty astonishing, I have to say. More recently the market has quietened, but there are many days like yesterday. Having TraderTV (Youtube) makes it all very much easier. They make a daily view, with all sorts of news stuff , then they give a list (sticky note) of suggested trades. You only need one or two, usually. You can only put money in one place at a time.

It's a routine,, they're doing the clever stuff, not me. One understands it, though.

Get a "paper" trade account and try it. Trading 212 isn't great but would do and it's all free. eToro is no good for day trading, for me, far too clunky, etc etc, T212 is run by a bunch of Bulgarians, but they have the approvals, fair range of stocks and ETFs etc.. There are loads of others, all free. There are plenty of people like AJBell, Fidelity, Interactive investor, HSBC etc to stuff larger amounts.

A good book to read is "Trading in the Zone" (free pdf online). It's only about the psychology, which is the hardest part. The nuts and bolts you'd pick up watching traders, they do a lousy amateurish educational bit to boost their youtube income, but it's ok. There are many others I could name, buttthere's no single book on how to day trade. The Dummies one on Swing trading is OK. I have some older ones, which are pretty hopeless, they're out of date. A lot is out of date, like 20, 40, 70 years out of date.

There's loads of detail but I hope that's enough to paint the picture..

Oooh look at ABercrombie and Fitch shares. Ihave some of those..... I think....

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

The Long Term accounts take up more and more time now. You do well if you get the sector rightHow much will be enough or would you just keep going to see how far you can go with it?

Go to AJ Bell's Fund Screener. You want Advanced filters, Risk rating 1 to 6, not 7. Then Performance, Annual performance, Trailing performance, then you can order by one week.

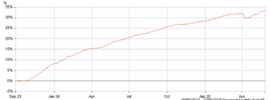

You should see something like this , right now. Clicky

When you can get about 4% per week, and it's been ok for a month, that'll do and it's a lot less effort than Day trading. Trading those at AJB is £1.50 and reduces. Fine. ii is fixed but higher dealing charges etc etc ad nauseam.

There are other platforms, ETFs, investment trusts, all sorts. But AJB has the best screener that I've found. They can be ISAs, pensions, or just cash accounts.

Each isa is now grown from its original 20k. 4% a week is about x7 in a year. It's surprising.

How far? See how it goes I suppose. I can't get out of the house much. so don't use much.

The "earn money" gene is still active.

Said to wife, go off on a holiday with your mates. Expecting she'd go exotic. Nope, Isle of Wight!

Move to Bonds which survive a recession better. Maybe hand it over to someone else to look after. You can do the numbers, with companies like HSBC paying a 10% dividend, tax free from an isa....

and so far that bond thing I use is still ok, surviving the Trump insult better than the S&P500...

WIth her indoors, outdoors, I'll have to heat up some beans now.

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

Understandable, sorry, I can try again if you want.All way above my head unfortunately...

If you just get your long term savings in somoething better tha a building society at 4%, result,

SOme stuff like options is currently way above my head, it's another world, where you can earn multiples of what II'm getting.

You need a quick mind, and I'm gettig on a bit.

Have a look at that graph at the end fthe previous post. If you have an ISA (you can split them) you might consider something like that fund. Depends what Rache says, too.Wow, I think I need to pass on all this and just be happy that I have a company and state pension that fulfil my basic needs of a few beers and holidays and that I can leave the kids a nice inheritance of the house (assuming me and the missis don't end up in care) but good luck with your investments

NVIDIA's results just came out. Not exciting, pity.

But their shares ARE up 70% in the last 6 weeks.

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

The previous 3 days haven't been exciting. Small p or l, nothing compared with that last good day.

Lets see for today. , for a start at least.

Euro stoxx have been doing ok but it'd al wallowing, too much Trump idiocy.

Long terms =- the Bondy thing is running at +0.05% per day or so, to the power 260, is decent.

WOrk it out : 1.0005 ^ (52 x5)

SS means Short... Scalps means buy the dips, sell the pop-ups. Fade means fall. SHort setup means failing to beat a Resistance Level, so it'll keep falling from it.

TSLA $358–360 SHORT – Lost the 360 level, now looking for short setups. China headlines = catalyst.

NVDA $140 SS – 2nd-day earnings play. Watching if yesterday’s fade continues.

PLTR $120 LONG – Weekly bottom getting tested. Long bias unless it breaks down. New US GOVT news and contracts.

TQQQ – China pressure, $70.50–71.00 = short scalp zone.

From

Lets see for today. , for a start at least.

Euro stoxx have been doing ok but it'd al wallowing, too much Trump idiocy.

Long terms =- the Bondy thing is running at +0.05% per day or so, to the power 260, is decent.

WOrk it out : 1.0005 ^ (52 x5)

SS means Short... Scalps means buy the dips, sell the pop-ups. Fade means fall. SHort setup means failing to beat a Resistance Level, so it'll keep falling from it.

TSLA $358–360 SHORT – Lost the 360 level, now looking for short setups. China headlines = catalyst.

NVDA $140 SS – 2nd-day earnings play. Watching if yesterday’s fade continues.

PLTR $120 LONG – Weekly bottom getting tested. Long bias unless it breaks down. New US GOVT news and contracts.

TQQQ – China pressure, $70.50–71.00 = short scalp zone.

From

Last edited:

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

Straightforward day The Tesla number was right, ish, in the guide above. A good example of only needing one "name". I did use the Nasdaq as well but might as well not have. The guide number is usally closer than that, but it was close enough to set the idea.

Total moves with hindsight, something about 7%.. I got about 5.

So with the 5x leverage, about 25%.

Market open was 14:30. Uh, OKO, it's going up, maybe to that 360, so you'd take it, and you can see from the shape of the candles when it's about to reverse. There's a bit of an S shape.

At the bottom the reverse was really clear (18:00). Easy to hit. . It went up then down about 1.8%. See how it hit the thin blue line and reversed - that's a common indicator. (50, movng average) Then the bottom, at 346 was already established.

Days like this are the bread and butter.

You don't need to be clever, you just be aware where levels and things are. The TTV youtube stream have live dicussion. Much of it junk, but hey.

So this week, 36% Tuesday then 25% is 1.36 x 1.25 which is 70%.

Very little judgement from the operator, who just goes with the plan. It tends to work well enough.

Losing trades? Sure, I made a nuber today, but they were irrelevant, they get stopped, and you let the winners go, so the losers are overwhelmed.

If all; had been perfectly executed it would have got 7% instead of 5%. I don't lose sleep over the 2%,

Total moves with hindsight, something about 7%.. I got about 5.

So with the 5x leverage, about 25%.

Market open was 14:30. Uh, OKO, it's going up, maybe to that 360, so you'd take it, and you can see from the shape of the candles when it's about to reverse. There's a bit of an S shape.

At the bottom the reverse was really clear (18:00). Easy to hit. . It went up then down about 1.8%. See how it hit the thin blue line and reversed - that's a common indicator. (50, movng average) Then the bottom, at 346 was already established.

Days like this are the bread and butter.

You don't need to be clever, you just be aware where levels and things are. The TTV youtube stream have live dicussion. Much of it junk, but hey.

So this week, 36% Tuesday then 25% is 1.36 x 1.25 which is 70%.

Very little judgement from the operator, who just goes with the plan. It tends to work well enough.

Losing trades? Sure, I made a nuber today, but they were irrelevant, they get stopped, and you let the winners go, so the losers are overwhelmed.

If all; had been perfectly executed it would have got 7% instead of 5%. I don't lose sleep over the 2%,

Last edited:

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

We can expect EU arms makers to do well. - as they have been doing. There are ETFs for that as well as the companies. Here's a few:

ALRT looks a bit too volatile to use other than within a day. Never heard of it.

SOme more (some same)

Note that some are leveraged 3x. Fine when they're rising, awful when they're not.

Note 3x EUD is +70% on the last month. I don't see it dropping, do you?

Be very careful with leveraged ETFs. You must use limit orders or you'll be guaranteed the wrong end of the candle. Even then the spread can be very wide,maybe 3%. ANd don't leave a "buy on open" order or you'll get the top end of a spike, which could lose you 10% instantly.

Stop losses are too dangerous to use, too.

ALRT looks a bit too volatile to use other than within a day. Never heard of it.

SOme more (some same)

Note that some are leveraged 3x. Fine when they're rising, awful when they're not.

Note 3x EUD is +70% on the last month. I don't see it dropping, do you?

Be very careful with leveraged ETFs. You must use limit orders or you'll be guaranteed the wrong end of the candle. Even then the spread can be very wide,maybe 3%. ANd don't leave a "buy on open" order or you'll get the top end of a spike, which could lose you 10% instantly.

Stop losses are too dangerous to use, too.

Last edited:

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

Looking long for NVDA today

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

NVDA was 2.2%, and then the old nag MARA 4%, so the mean was between the two. I wasn't there all day.

3% on 5 leverage is 15%. Beats the Bldg Soc, for, like, 3 years.

Holding a little bit of Crowdstrike. That's the anti hacking company which screwed up with a new version of software and crashed Windows on some fairly important computers being used for booking flights etc.

One should never hold shares through earnings, it's a lottery. But it can be fun. If it jumps, sell and take the profit (though it's often better to hold on). If it dumps 10% you buy more, and it bounces back up within a day or so, etc.

Sometimes it's a Craig Revell-Horwood disaaaahster dahling, but not very often.

3% on 5 leverage is 15%. Beats the Bldg Soc, for, like, 3 years.

Holding a little bit of Crowdstrike. That's the anti hacking company which screwed up with a new version of software and crashed Windows on some fairly important computers being used for booking flights etc.

One should never hold shares through earnings, it's a lottery. But it can be fun. If it jumps, sell and take the profit (though it's often better to hold on). If it dumps 10% you buy more, and it bounces back up within a day or so, etc.

Sometimes it's a Craig Revell-Horwood disaaaahster dahling, but not very often.

- Joined

- 31 May 2016

- Messages

- 25,296

- Reaction score

- 5,582

- Country

How can you SHORT above the current price? That doesn't make any sense.

There is more to NVDIA gains than their earnings. The market was worried they were getting eaten by cheaper options. They signed some pretty big deals for with AI superscalers and hyperscalers in the their results.

There is more to NVDIA gains than their earnings. The market was worried they were getting eaten by cheaper options. They signed some pretty big deals for with AI superscalers and hyperscalers in the their results.

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

To you maybeHow can you SHORT above the current price? That doesn't make any sense.

You don't say what you're referring to, but e.g. if a price is 45 and the "level" is established at 50, it could make sense to leave a Short order at 51 .

The "stop" is at 51, which is confusing because it actually means "go". It's like a trigger. You can ;leave a Stop-loss at 52 and a Take profit at 40, or wherever.

Is that it??

The Crowdstrile result did go against me , so I did what I said I would:

A stop-loss arrested the drop about where the yellow line is.

For illustration, say I lost 10, from 490 to 480.

So I waited for the bounce There isn't ALWAYS a bounce, but usually. I went LONG through the purple arrow, with more shares, so made the money back.

It'll probably come back up in the coming days, but it had't actually dropped further than its price was in the last week or two.

Hell no, profits and share prices are practically unrelated. Lots of money is made trading stocks which don't ever make a profit.

It can be just speculation on the price, not the company! Things like quantum computing.....

Last edited:

- Joined

- 31 May 2016

- Messages

- 25,296

- Reaction score

- 5,582

- Country

You’re going to have to simplify.

Price today 45. If I short I am betting the price goes down. If I’m long I’m hoping it goes up. Unless you think the momentum of a stock allows you to short at 50 on a specific date in the hope that someone takes your order and the price is lower at that date. But surely they will just take your 50 at 45 and if it goes down. Your hosed?

Price today 45. If I short I am betting the price goes down. If I’m long I’m hoping it goes up. Unless you think the momentum of a stock allows you to short at 50 on a specific date in the hope that someone takes your order and the price is lower at that date. But surely they will just take your 50 at 45 and if it goes down. Your hosed?

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

No not dates, price levels.

I'm not quite sure where the penny isn't dropping, so I'll go back a bit, so some of this is egg-sucking info...

When you set up a trade to sell or buy "at" a particular price, the particular price is called the STOP.

It's a trigger point.

So you can have a stop-buy :

- Buy when the price gets down to 40

- Buy when the price gets up to 40

or a stop sell

- Sell when the price gets down to 40.

- Sell when the price gets up to 40

If the price is jumping about, its hitting or passing the STOP enables the trade, wherever the price goes. So your trade start or stop point isn't guaranteed exactly.

(LIMIT orders are almost the same but they guarantee the max or min).

Two of those seem illogical - why would you wait until the price has gone up before you buy?

Why would you wait until the price has gone down before you sell?

--

Prices go in RANGES, between LEVELS. The levels are ridiculously predictable, bound into the positive feedback mechanism by the Bots which do most trading. They appear random, but can maintain their validity for years.

An example is the oil price. It'll often spend all day going slowly between whole price-per-barrel numbers. Up and down between 61 and 62, then it might "break" above 62 and not stop rising until it gets to 63, where stock holders have go their SELL STOPS set.

One could write a book on what determines levels, there are many indicators.

If you Google Range Trading, you'll get loads of pics.

Often the price will be hitting, and "bouncing off" just one level. Then it'll either go through the level , or hang around at it and then head up or down for some other reason. You can set trades which wait, until the levels are hit.

Here's an ideal range trade:

The price is at 45 in the pink circle rising, so your Current trade might have a Take Profit (A Sell Stop) at 50 (pink trade)

You can, right now, enter a trade SHORT at 51, expecting the price to come back down again.

You would add to that trade a STOP LOSS at 52, in case the price carried on up.

You would also add to it a Take Profit (Stop sell) at 41. That would be the green trade

You could also enter NOW the next, rising trade, enter long at 40 (buy stop), stop loss (sell stop) 39, Take Profit 50, and go to bed.

If green never triggered, blue may or may not happen.

Often the range is rising or falling. The wise plan then id to only go WITH THE TREND. so if you miss the range boundaries, you just wait and it'll hit it on the next wave.

The upper bound is called the resistance, and the lower one support.

Further reading for homework: https://priceaction.com/price-action-university/strategies/support-resistance-levels/

I'm not quite sure where the penny isn't dropping, so I'll go back a bit, so some of this is egg-sucking info...

When you set up a trade to sell or buy "at" a particular price, the particular price is called the STOP.

It's a trigger point.

So you can have a stop-buy :

- Buy when the price gets down to 40

- Buy when the price gets up to 40

or a stop sell

- Sell when the price gets down to 40.

- Sell when the price gets up to 40

If the price is jumping about, its hitting or passing the STOP enables the trade, wherever the price goes. So your trade start or stop point isn't guaranteed exactly.

(LIMIT orders are almost the same but they guarantee the max or min).

Two of those seem illogical - why would you wait until the price has gone up before you buy?

Why would you wait until the price has gone down before you sell?

--

Prices go in RANGES, between LEVELS. The levels are ridiculously predictable, bound into the positive feedback mechanism by the Bots which do most trading. They appear random, but can maintain their validity for years.

An example is the oil price. It'll often spend all day going slowly between whole price-per-barrel numbers. Up and down between 61 and 62, then it might "break" above 62 and not stop rising until it gets to 63, where stock holders have go their SELL STOPS set.

One could write a book on what determines levels, there are many indicators.

If you Google Range Trading, you'll get loads of pics.

Often the price will be hitting, and "bouncing off" just one level. Then it'll either go through the level , or hang around at it and then head up or down for some other reason. You can set trades which wait, until the levels are hit.

Here's an ideal range trade:

The price is at 45 in the pink circle rising, so your Current trade might have a Take Profit (A Sell Stop) at 50 (pink trade)

You can, right now, enter a trade SHORT at 51, expecting the price to come back down again.

You would add to that trade a STOP LOSS at 52, in case the price carried on up.

You would also add to it a Take Profit (Stop sell) at 41. That would be the green trade

You could also enter NOW the next, rising trade, enter long at 40 (buy stop), stop loss (sell stop) 39, Take Profit 50, and go to bed.

If green never triggered, blue may or may not happen.

Often the range is rising or falling. The wise plan then id to only go WITH THE TREND. so if you miss the range boundaries, you just wait and it'll hit it on the next wave.

The upper bound is called the resistance, and the lower one support.

Further reading for homework: https://priceaction.com/price-action-university/strategies/support-resistance-levels/

Last edited:

- Joined

- 31 May 2016

- Messages

- 25,296

- Reaction score

- 5,582

- Country

So you are Selling stock you don't have at 51 in case it goes to 51 (Shorting), you place a limit at 52 to reduce your exposure.The price is at 45 in the pink circle rising, so your Current trade might have a Take Profit (A Sell Stop) at 50 (pink trade)

You can, right now, enter a trade SHORT at 51, expecting the price to come back down again.

You would add to that trade a STOP LOSS at 52, in case the price carried on up.

You would also add to it a Take Profit (Stop sell) at 41. That would be the green trade

So if the price goes 51 and then drops to 41, You exercise your position, but if the price goes to 53 - and then drops to 45 you are screwed. But if the price just floats around the current value at 45 +- 2. you never execute so don't have the simple risk of buying today at 45 only to see it drop to 43. But at the same time you miss out if it rises.

This makes sense.

- Joined

- 22 Aug 2006

- Messages

- 7,093

- Reaction score

- 1,205

- Country

Don't annoy the President:

Um...

So you are Selling stock you don't have at 51 in case it goes to 51 (Shorting), you place a limit at 52 to reduce your exposure.

(pink trade) Wouldn't put it that way ... If you sell at 51 and it goes up to 52, it buys back, so you lose 1. End of trade.

So if the price goes 51 and then drops to 41, You exercise your position,

No it's not an "Option" trade needing exercising,, it just happens.. If you sell (short) from 51 and it gets to your stop at 41 then you made 10. End of trade.

If it goes to 51 then sideways East, at 45 forever you can just close it for a win of 51-45 =6. If you aren't there and it meanders back up to 52, the trade is still open so it buys, for aloss of 1.

but if the price goes to 53 - and then drops to 45 you are screwed.

No you sold at 51, and it bought back at 52, so that's the same loss of 1. End of trade, nothing else happens there.

But if the price just floats around the current value at 45 +- 2. you never execute so don't have the simple risk of buying today at 45 only to see it drop to 43.

Correct

But at the same time you miss out if it rises. If ignoring the pink trade, yes.

Assuming the Pink trade is history, then you would only have a trade if the price rose to 51 (green starts) or dropped to 40.(blue starts).

---

The mechanism of "shorting" is odd to get your head round.

Think of it that you BORROW the shares, and sell at the current price. If the price drops, you BUY shares to replace the ones you borrrowed, trousering the difference in price because the shares are cheaper than when you sold the ones you borrowed.

Um...

So you are Selling stock you don't have at 51 in case it goes to 51 (Shorting), you place a limit at 52 to reduce your exposure.

(pink trade) Wouldn't put it that way ... If you sell at 51 and it goes up to 52, it buys back, so you lose 1. End of trade.

So if the price goes 51 and then drops to 41, You exercise your position,

No it's not an "Option" trade needing exercising,, it just happens.. If you sell (short) from 51 and it gets to your stop at 41 then you made 10. End of trade.

If it goes to 51 then sideways East, at 45 forever you can just close it for a win of 51-45 =6. If you aren't there and it meanders back up to 52, the trade is still open so it buys, for aloss of 1.

but if the price goes to 53 - and then drops to 45 you are screwed.

No you sold at 51, and it bought back at 52, so that's the same loss of 1. End of trade, nothing else happens there.

But if the price just floats around the current value at 45 +- 2. you never execute so don't have the simple risk of buying today at 45 only to see it drop to 43.

Correct

But at the same time you miss out if it rises. If ignoring the pink trade, yes.

Assuming the Pink trade is history, then you would only have a trade if the price rose to 51 (green starts) or dropped to 40.(blue starts).

---

The mechanism of "shorting" is odd to get your head round.

Think of it that you BORROW the shares, and sell at the current price. If the price drops, you BUY shares to replace the ones you borrrowed, trousering the difference in price because the shares are cheaper than when you sold the ones you borrowed.