Right, I had a chance to look them up.

AI picked those? I wonder why.

I'm assuming this isn't ALL your savings. And I'm assuming you ARE prepared to look at and change things if necessary, looking say every 3-4 weeks or more often. It'll be on your phone. I keep most of my funds at least a month, some near a year. If you switch too often you have a period of nothing. How keen you'd be to get out if you saw them drop, is a difficulty we all have. It's easy to do nothing. If you aim to sell and rebuy, you'll get both timings wrong.

See if you can find out what others think about the chances of recovery if something dips. If you sell and wish you hadn't, you DID avoid the risk of the stock going down further, which is worth something. Gold, say, could dip and keep dipping. Have a limit, 10% or something - up to you, and stick to it - get out at that level

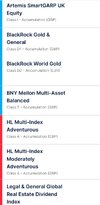

I wouldn't pick many of them, tbh.

- The Artemis smart Garp funds are pretty good in their sector.

- You have two gold/silver ones. They'll be about the same as each other.

- The three Multi-asset ones will be very similar to each other too. The ones from the same company will be almost identical.

Your AI doesn't seem to have sought much diversification or looked at last year's results.

History doesn't repeat, but it rhymes.

Stocks' behaviours do NOT revert to the mean of each other.

Crap last year is fairly likely to be crap again.

Orange and grey earned you nothing - maybe dividends, I chose the non divi paying versions (That's what Acc means).

Smart GARP

UK. Why? Smart Garp Europe did better. Both performed pretty well. Your UK one (yellow) is the best performer you have.

Smart Garp global was a bit under.

But that Artemis Global Income I'm using is actively managed, better diversified, and did particularly well in the last month. Whatever is in its mix, it's doing well recently.

Multi asset funds are always sort of boring, 10% or so.

The gold funds got 180% in the last year

DIversification is ok if you don't know where to put your money, Warren Buffet says.

Best fund in its sector could be a wise choice, but that's not what you've got

Your gold and silver will, at recent performance, overwhelm most of the others,. They also might give you a choppy ride. They might well take a hit in the next couple of days.

Governments have been buying gold. If a big buyer has enough and stops, the price could dip. 20%, 30%, have happened in the past. Did you look that up?

Using well-performing funds with basically just one asset in them, could hurt you.

If you "dollar cost averaged" (look that up" your way in, you could expect to get a good sum built up so a 30% hit wouldn't hurt much relative to what you started with.

The multi asset funds aren't ever particularly "good" -they match the SPY pretty much.

At 10% though, you could find something like a Corporate bond or Strategic bond which is NOT related to company prices. they get their money from loan interest. SImilar return, real diversity.

Real Estate, isn't usually something you'd want to hold for long.

You've missed out on Asia Pacific, specifically Korea. It's on fire.

"Emerging Markets" funds would get you a slice of that. They all do well when the dollar drops, and Trump is busy slashing it.

SO you have a strange bunch, in may ways.

A word on diversification.

Bowler hatters often go nuts on diversification. They seem to think there's merit in having stocks which never move.

If you can diversify into unrelated funds which all return about the same, great. At the moment, that might be Korea, Gold , (maybe gas/ Oil for a shortish spell if Trump gets sillier.

Brazil has been doing well and so on.

You'd have to be quick and careful using those though.

There are decent reasons to expect Korea to do well for a period.

If you're using gold, it has been doing so well that it overwhelms at least two of the funds in your mix. There's no point having the weak ones, unless this is ALL your savings. Never put all your savings in one place, use Fixed interest, property etc

In this account the 180% from the golds overwhelms the 0 and 10% returns.

So decide whether it's a long - term leave , or a punt.

If the latter, lets behave as though the pattern continues for a while, but be cautious.

Perhaps:

Start with a couple or three of the 40% or better per annum funds - there are many of those. Look at the Screener at AJBell.

Then buy say some gold, some Korea, perhaps 5% of each if they're doing better. Each month, ease your way into the better payers.

Once you have built up enough, you will be able to afford that dreaded 30% hit, so you can stay all-in them.

Your nerves may take over, then.

Use any warning you have about the best returners beginning to fail, because they may do so at a rapid rate, and it will take you a couple of days to realise and get your funds out. You can't set stop-losses. If they go flat, sell and hold.

Edit: I see the metals are dropping a couple or more percent today.

This is where you realise the difference that some like to invent between investing and trading. It's just about the timing.