Labour have simply continued a Tory policyincrease in income tax ~9-12% over next 3 years

From OBR

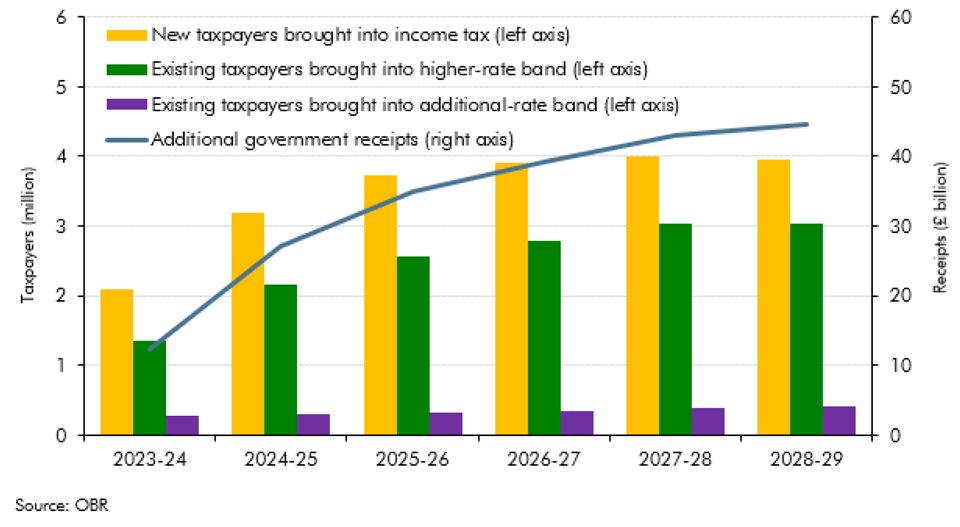

- In March 2021, the income tax personal allowance (PA) was frozen at £12,570 and the higher rate threshold (HRT) at £50,270, from 2022-23 to 2025-26. The freezes were extended for a further two years in November 2022, when the upper earnings limit and upper profits limit for NICs were also frozen, meaning all these allowances and thresholds were to be frozen to 2027-28.

Fiscal implications of personal tax threshold freezes and reductions - Office for Budget Responsibility

This box discussed the continuing impact of the multiple freezes and changes to personal tax thresholds between March 2021 and November 2022. It provided an update on the estimated receipts from these policies, and the additional number of tax payers by tax band.