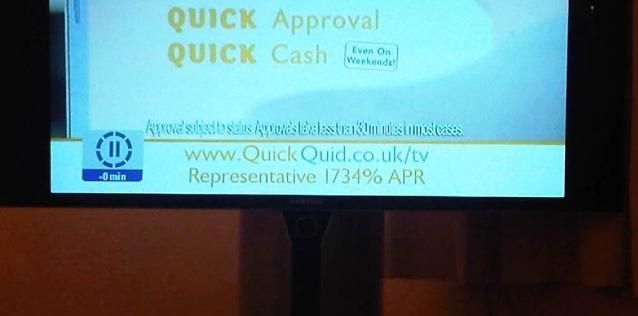

they portray someone with the weight off the world due to a shortfall in financess as being happy and relieved at the opportunity to throw away 25% off there hard earned income in interest charges for a months loan that will throw them further into the evil short term loan disease

they should be banned or at least show people crying as they become progresivley more destitute by throwing more money away in needless charges

if they take out a loan each month by the year end approching half there income will go to these evil leaches

they should be banned or at least show people crying as they become progresivley more destitute by throwing more money away in needless charges

if they take out a loan each month by the year end approching half there income will go to these evil leaches