- Joined

- 22 Aug 2006

- Messages

- 7,180

- Reaction score

- 1,223

- Country

Late wife's accounts have passed to me, mostly. (A couple of banks want a certified copy of my birth cert, marriage cert, death cert, even though I've had accounts with them for decades. Too busy for those.)

HSBC did the transfers no problem, I thought.

HMRC sent me a cheque, as she'd overpaid, with a one-side statement of how they got the number.

So far, found two mistakes on it.

A couple or four years ago they said she didn't need to fill in a self-declaration.

But they make numbers up, and assume.

They assumed she still had interest, at the same rate, from a fixed-rate account she closed 2 years ago.

And they want to tax dividends which came from shares which were moved into an ISA.

It took half hour calls to HSBC and First Direct which HSBC owns, to track things down.

HSBC "found" another account she had, untouched for several years, I had no idea about. Sheezus. So when I was on to First Direct, I asked them if they could do a search as well. " Oh. they'd all appear on the record. But I can check if you really want me to. They laughed about the one HSBC had "lost".

They found an old account as well. !*&%$!

So later, I'm logged on to HMRC to do my own tax form, late as usual, but I have a few days. It's always a bit of a mission, I'm complicated.

It appears I won't have to pay any tax whatsoever, because, it said,

I'm dead.

Should I tell them?

HSBC did the transfers no problem, I thought.

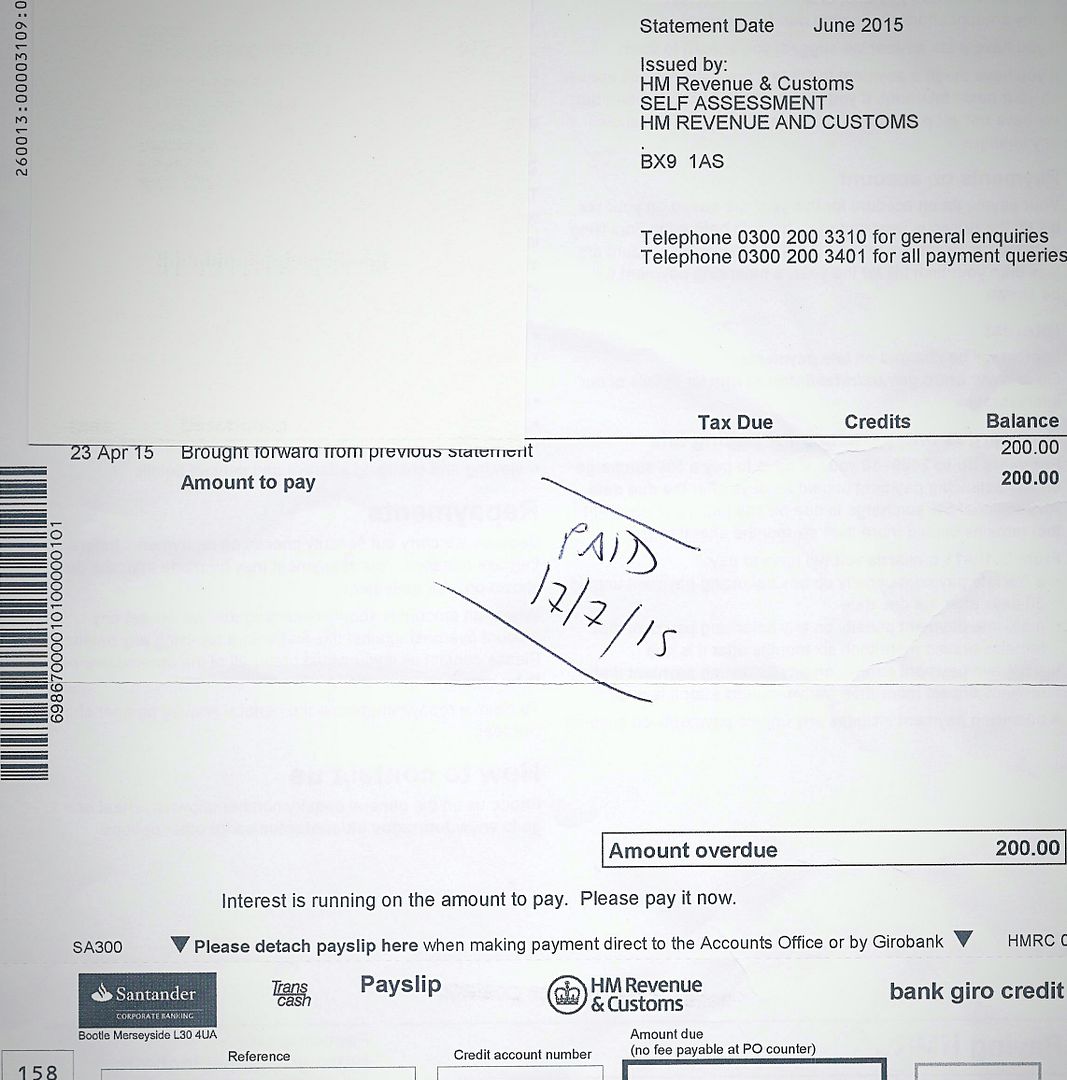

HMRC sent me a cheque, as she'd overpaid, with a one-side statement of how they got the number.

So far, found two mistakes on it.

A couple or four years ago they said she didn't need to fill in a self-declaration.

But they make numbers up, and assume.

They assumed she still had interest, at the same rate, from a fixed-rate account she closed 2 years ago.

And they want to tax dividends which came from shares which were moved into an ISA.

It took half hour calls to HSBC and First Direct which HSBC owns, to track things down.

HSBC "found" another account she had, untouched for several years, I had no idea about. Sheezus. So when I was on to First Direct, I asked them if they could do a search as well. " Oh. they'd all appear on the record. But I can check if you really want me to. They laughed about the one HSBC had "lost".

They found an old account as well. !*&%$!

So later, I'm logged on to HMRC to do my own tax form, late as usual, but I have a few days. It's always a bit of a mission, I'm complicated.

It appears I won't have to pay any tax whatsoever, because, it said,

I'm dead.

Should I tell them?