You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

State pension amount.

- Thread starter Mottie

- Start date

There are TWO state pensions. Old and New.

35 only applies to those retiring in 2016+35 = 2051 (i.e. whole working life under New State Pension rules) and assuming nothing changes before then.

Basic Old State Pension is less than the new https://www.gov.uk/state-pension/how-much-you-get

Most people will be under transitional rules between Old and New State Pension.

State Pension forecasts do sums based on individual records, contracted in/out any earnings related extra state pension (under Old SP) and spits out an amount that is the best of the two: old rules or new rules.

If there are missing years or part years that can improve the forecast they are typically worth buying if one is no longer working.

35 only applies to those retiring in 2016+35 = 2051 (i.e. whole working life under New State Pension rules) and assuming nothing changes before then.

Basic Old State Pension is less than the new https://www.gov.uk/state-pension/how-much-you-get

Most people will be under transitional rules between Old and New State Pension.

State Pension forecasts do sums based on individual records, contracted in/out any earnings related extra state pension (under Old SP) and spits out an amount that is the best of the two: old rules or new rules.

If there are missing years or part years that can improve the forecast they are typically worth buying if one is no longer working.

- Joined

- 11 Jan 2004

- Messages

- 46,066

- Reaction score

- 3,582

- Country

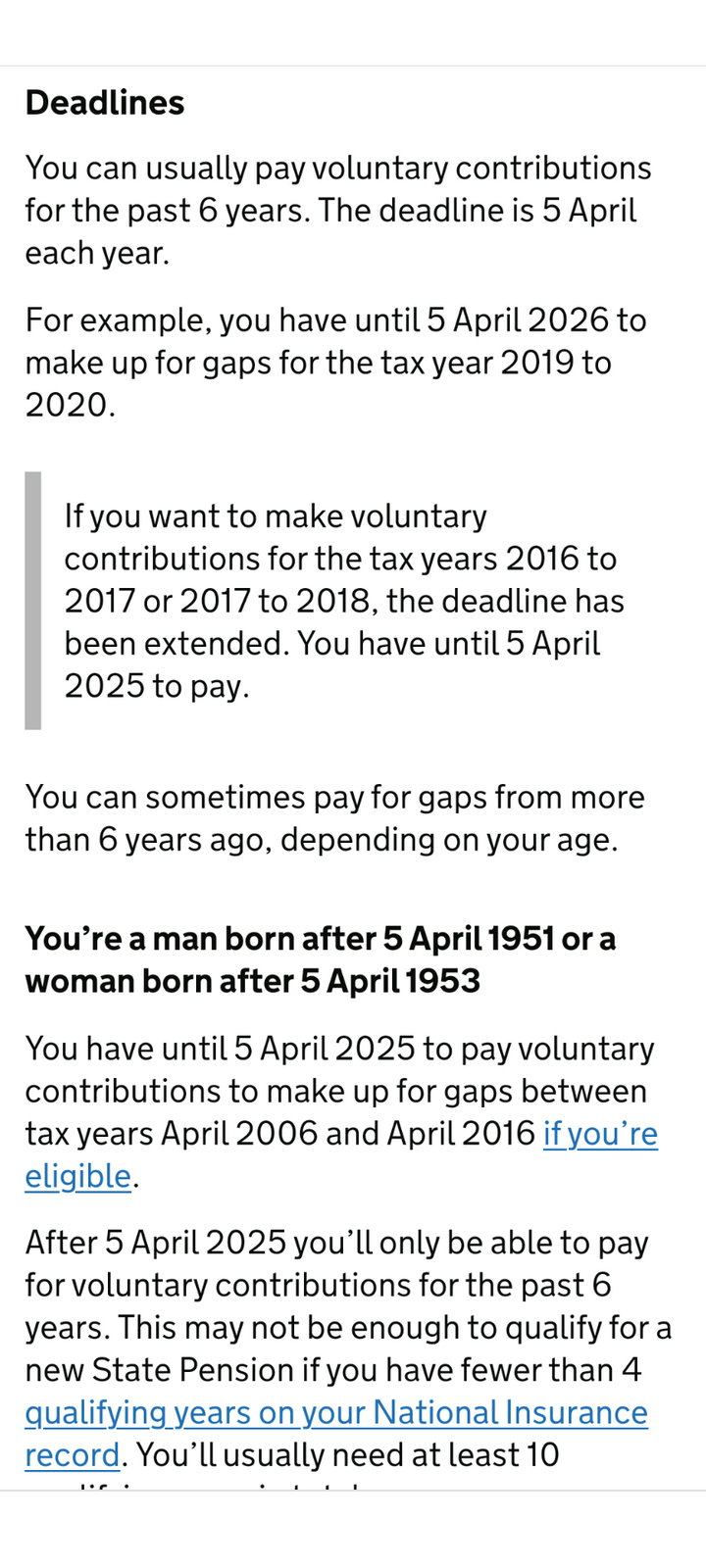

There are limits time-wise with this, though.

Yes there are normally. Only the past 6 years.There are limits time-wise with this, though.

But there is currently in place a temporary extension to 5th April 2025 (i.e. next year) to buy NI contributions for gaps between April 2006 and April 2016 (if eligible) and also 16-17 and 17-18 years. So up to 19 years worth.

As your screen grab shows.

NB buying old (pre 2016) years won't always add to the state pension amount.

A call to the future pensions people is essential if considering filling those older years.

Quite possibly wise for other, later, years too.

Anyone considering doing the earlier years needs to get a wiggle on. The current extension was caused by too many leaving it until the very last minute for the previous deadline!

- Joined

- 22 Aug 2006

- Messages

- 7,108

- Reaction score

- 1,212

- Country

GIve them a call to be sure. They've been very good with us. As you've done the request for the amount, they will have your up to date info on the system. Probably about a 1 minute conversation, but worth it for peace of mind.well i will go with what the government site says , going by how many times you are wrong about stuff .

Dont forget even when contracted out NI is still paid.

Every year says full year

They do make a lot of mistakes. Like with that wording which is obviously wrong.

peace of mind what for the less than 200 hundred quid standard bill that i will get in april for already working the past year .That then gives me full pension .GIve them a call to be sure. They've been very good with us. As you've done the request for the amount, they will have your up to date info on the system. Probably about a 1 minute conversation, but worth it for peace of mind.

They do make a lot of mistakes. Like with that wording which is obviously wrong.

It is up to date as the pension figure changed from last year when it was 2 years req

Considering what I’m getting, I’m surprised to see this on my record. I wonder whether it will be worth paying the extra?Just had a letter. It’s going up. With the triple lock our wonderful government are giving us, I’ll be getting £1,040.80 every 4 weeks). My mate got a letter too. He'll be getting £1,075 every 4 weeks.

- Joined

- 7 Jan 2010

- Messages

- 14,194

- Reaction score

- 4,207

- Country

Although I have 42 years full contributions, my forecast is £174 a week, I can make payments of £800 odd a year for 8 years to get up to £192 a week, so it will take years once I start taking my pension before I break even. I won't bother.

- Joined

- 11 Dec 2012

- Messages

- 4,542

- Reaction score

- 2,262

- Country

Although I have 42 years full contributions, my forecast is £174 a week, I can make payments of £800 odd a year for 8 years to get up to £192 a week, so it will take years once I start taking my pension before I break even. I won't bother.

Your forecast doesnt seem right. I would ring them to check.

Considering what I’m getting, I’m surprised to see this on my record. I wonder whether it will be worth paying the extra?

View attachment 334563

Well, 42 minutes on hold to be told that I need to phone the 'future pensions dept'. He said it’s not worth him putting me through as I won’t get to speak to them at this time of day. He gave me their number. I got through after 'only' 18 minutes on hold. She asked how much I was getting and I told her I was getting £240 a week and she told me the max is £203 so if I paid that voluntary 'shortfall' of £824, I’d get nothing for it so she told me to just ignore it. That’s that sorted then…I got 2 gaps in mine. £824.

It states that my pension will be £203 though. So, not worth paying them £1600 plus!

See Martin Lewis on the subject.

Ring Future Pensions.Although I have 42 years full contributions, my forecast is £174 a week, I can make payments of £800 odd a year for 8 years to get up to £192 a week, so it will take years once I start taking my pension before I break even. I won't bother.

Not all 8 years short will add to your pension - especially pre 2016.

It's essential you only buy the ones that will add.

Each additional year bought should add around £5.82 per week to the pension paid (current 23-24 rate, it'll go up in April by 8%). That's typically recovered in under 3 years of taking the pension... but a bit longer if 20% taxpayer.

From your numbers it is likely that only 3 years are needed and buying a 4th will add pennies so probably not worth buying? But you need to do the sums accurately to make the decision.

Do ring Future Pensions.

- Joined

- 22 Aug 2006

- Messages

- 7,108

- Reaction score

- 1,212

- Country

As is always the case, you don't have a full grasp of the subject even though you think you do. That's why you post so much crap.peace of mind what for the less than 200 hundred quid standard bill that i will get in april for already working the past year .That then gives me full pension .

It is up to date as the pension figure changed from last year when it was 2 years req

As others say, the possibility of someone having got something screwed somewhere is significant so most would say it's worth a call.

And as per usual people like yourself dont believe the written word .As is always the case, you don't have a full grasp of the subject even though you think you do. That's why you post so much crap.

As others say, the possibility of someone having got something screwed somewhere is significant so most would say it's worth a call.

I have full grasp of the situation i know roughly how many years i was contracted out i know that you now have to have 35 years contributions and the figures they have given me in the past and at present tally up .

I am amazed someone like yourself is worried about a few quid missing when you are making thousands daily . The time it took you to phone them you could have been playing the market making ten fold .

- Joined

- 22 Aug 2006

- Messages

- 7,108

- Reaction score

- 1,212

- Country

Yeah ok, but how many years?Although I have 42 years full contributions, my forecast is £174 a week, I can make payments of £800 odd a year for 8 years to get up to £192 a week, so it will take years once I start taking my pension before I break even. I won't bother.

Something sounds odd, You only need 35 "full" years, for a full pension no?

How long do you plan to live past your pension age?

192-174 is +£936 a year, inflation linked.

If you save the money, what are you going to do with it to keep pace with inflation? Did you get 8.5% this year?

Only 4.5% perhhaps. Losing 4% over 8 years means you lose 28% of it.

Speak to someone wot knows, but the self-employed NI is low. £3.45 /week, - errm just under £180 a year.

So 800 per year sounds odd.

You can choose to pay NI even if you don't earn above the threshold which is £6000 odd.

Good case for a phone call?